Outlook

- Dogecoin needs to clear resistance at $0.38 (Tuesday’s high) to invalidate the lower highs setup on the daily chart.

- A breakout, if confirmed, would allow progress toward $0.60.

- However, Monday’s failed breakout suggests scope for a deeper drop in the short term.

The meme-cryptocurrency dogecoin (DOGE) looked primed for an upside move earlier this week after it exited a downward channel identified by descending trendlines derived from May 8 and May 14 highs and May 12 and May 19 lows.

However, the move higher following Monday’s breakout was quickly stopped in its tracks by sellers near $0.38. Now, the cryptocurrency has pulled back even further to $0.32, securing a foothold below the 50-day SMA (simple moving average) and establishing a bearish lower high at $0.38.

Price chart: Daily

The lower high, coupled with the downward trending 10-day SMA and the bear cross of 10-and 50-day SMA, suggests scope for a renewed decline toward $0.24 – the descending trendline that previously as resistance.

The next support, and perhaps the most important from a longer-term perspective, resides around $0.2070 (100-day SMA).

A break above $0.38 would be a good time to take a long exposure, as that would violate the lower highs setup and shift attention to $0.59 (May 14 high). However, forcing a breakout above $0.38 is easier said than done, as longer-duration technical indicators are flashing a bearish signal.

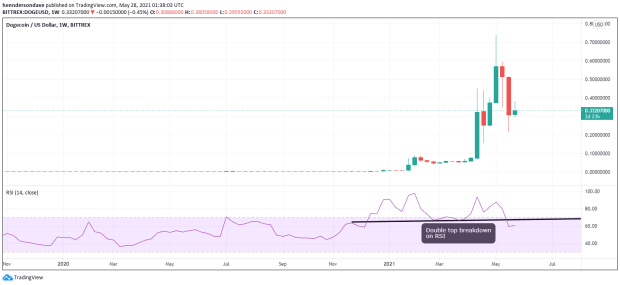

Price chart: Weekly

The double top breakdown seen on the weekly chart RSI (relative strength index) indicates the macro trend has flipped bearish, and rallies could run into selling pressure.

The indicator needs to close above the double top horizontal resistance (former support) to revive the bullish outlook.

Price chart: Hourly

The Bollinger bands have tightened, indicating a low-volatility price squeeze, which often ends with a violent price move. Simply put, a big move could happen soon, possibly to the downside, as daily and weekly charts are biased bearish.

This is a guest post. Investing in cryptocurrencies is speculative and investors should carefully conduct all research and diligence before making trades.