Cryptocurrency markets have risen for a second straight day, gaining after US Federal Reserve officials pledged to keep monetary policy loose for years.

Fed chairman Jerome Powell said the central bank would keep its benchmark interest rate near zero and continue buying at least $US120bn ($153.36bn) in bonds a month as a means to stimulate the US economy, even if it meant a bump in inflation.

Gold prices, tech stocks, commodities and cryptocurrencies all rose after Powell’s dovish speech, while the US dollar dipped and bond yields eased.

“Not sure what dots you guys are talking about, because the only thing I’m hearing from Powell today is ‘Buy more Bitcoin’” — @NeerajKA

— Joe Weisenthal (@TheStalwart) March 17, 2021

jerome powell go “just a lil inflation but dw”

money printer keeps going brr

bitcoin do a lil dance until jerome powell stops talking

inflation goes up more than just a lil

bitcoin go up a lot more than just a lil

— ⚔️ MAREN ⚔️ (@marenaltman) March 17, 2021

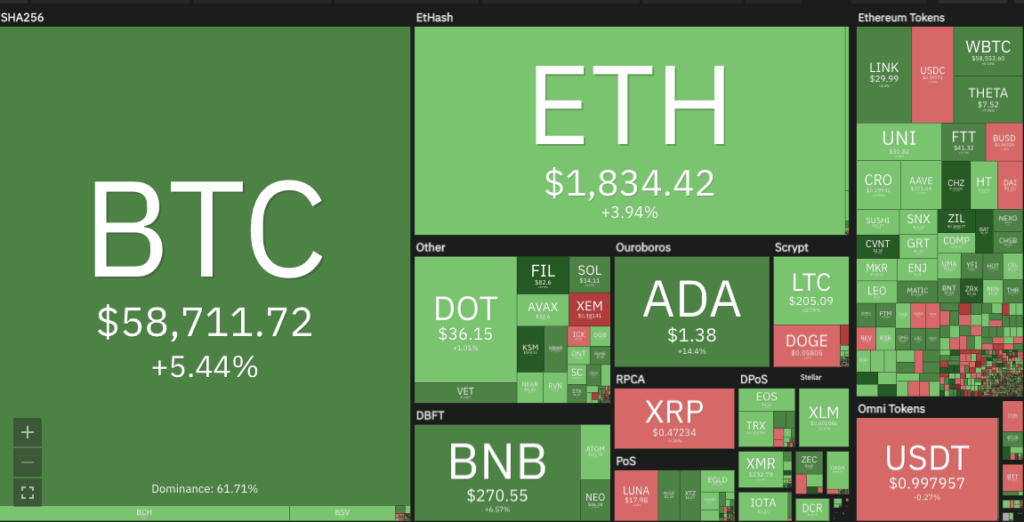

Bitcoin rose from $US55,500 to a three-day high of $57,400 within half an hour of the central bank’s announcement, which came at 5am AEDT/2pm EDT. By 2.26pm AEDT, the king of cryptocurrencies had risen further, trading at $US58,853 ($75,500), up 5.15 per cent from 24 hours ago. It had traded as high as US$59,391 around 1.30pm.

Ethereum was trading at $1,832 ($2,360), up 3.5 per cent from a day ago, and nearly every altcoin in the top 100 was in the green again this afternoon.

Of the top 100 assets on Coingecko, just 11 had lost ground in the past 24 hours, including four stablecoins that often dip marginally when the market rallies.

Zilliqa up 21%

Zilliqa (ZIL) has been the top performer, rising 21.4 per cent to US18.6c after the Singapore-based team behind the project released a new platform that will let users earn rewards for engaging with brands on social media.

1/14 “SocialPay will melt faces” – @ColinMiles

He’s definitely not wrong, #Zilliqa is changing the #SocialEconomy and disrupting marketing ⚡️#SocialPay “2.0” MVP with #NFTs has arrived ➡️ https://t.co/ns9rhjB0td

What’s exciting about it? 👇 pic.twitter.com/FiyOOMPdxt

— Zilliqa (@zilliqa) March 18, 2021

#Zilliqa might hit ATH this week, even then I’ll be hodling 🚀🚀🔥🔥.

— ziltothemoon (@hodlzilliqa) March 17, 2021

Bitfinex’s LEO Token, Basic Attention Token, Compound Ether (cETH), Kusama and Nexo were the coins in the top 100 that had hit all-time highs in the past 24 hours, according to Coingecko. Kusama is a “wild and fast” version of Polkadot, while cETH is a token released by the Compound protocol designed to let hodlers earn interest on their cryptocurrency.

Strong fundamentals

Overall sentiment on Crypto Twitter was very bullish, given how quickly the market has recovered from Monday’s 10 per cent dip. Pullbacks in January and February were more prolonged and severe.

The Inverse Head & Shoulders pattern is a bearish reversal pattern 💯 #Bitcoin 🚀 🌖 pic.twitter.com/YcycL1e4wp

— PabloASXco₿ar (@PabloASXcobar) March 18, 2021

Also, overnight CNBC reported that Morgan Stanley would become the first big US bank to let its wealthy clients invest in Bitcoin, while Visa chief executive Al Kelly said that the payments giant was working to integrate the cryptocurrency into its systems.

“We’re trying to do two things; one is enable the purchase of Bitcoin on Visa credentials, and then secondly working with some Bitcoin wallets to allow the Bitcoin to be translated into a fiat currency,” he said on a podcast, according to Decrypt.

The latter would enable 70 million merchants around the world to accept Bitcoin as a payment method, he said.

#Bitcoin will go mainstream so quickly it’s going to surprise even the most bullish of us.https://t.co/6du825TOpc

— Lina Seiche (@LinaSeiche) March 17, 2021

Americans also began receiving their $US1,400 ($1,790) stimulus checks this week.

Lastly but certainly not least, a strong supply of new memes was making its way into the cryptocurrency space.

The Great USD Flood#Bitcoin pic.twitter.com/WcJZPAK8Zp

— CMS Intern (@cmsintern) March 17, 2021