This article was written exclusively for Investing.com

- Bitcoin and Ethereum choppy near the highs

- Theta: top-15 member of the asset class

- Filecoin: in the top twenty

- Rising market caps build a critical mass for the future

- Look for diamonds in the rough in the crypto patch

The cryptocurrency asset class continues to be one of the most exciting market sectors of 2021. It is hard to believe that its leader, , was trading below 10 cents just eleven years ago. The most recent high for the token, at $62,080, is why many investors are searching for the next explosive coin. The chance to turn a $1 investment in 2021 into over a half-million dollars at the end of last week with Bitcoin north of $59,000 is a lotto ticket.

The unprecedented rise of many digital currencies could mean the low-hanging fruit is already off the trees. However, some asset class devotees believe that the price appreciation has a long way to go.

Finding value in the sector requires homework. For today’s bargains to become tomorrow’s superstars, they need liquidity to build the critical mass for success. and are two tokens that are in the top tier of the asset class. They have already established some of the basic requirements for future success and higher values.

Bitcoin and Ethereum choppy near the highs

March was a choppy month in the and futures markets. Bitcoin made a new record high on Mar. 15.

Source: CQG

The chart highlights the move to a high of $62,080 in mid-March and a decline to $50,595 ten days later. Bitcoin corrected 18.5% from the high. The price was back at the $60,000 level on the last day of March.

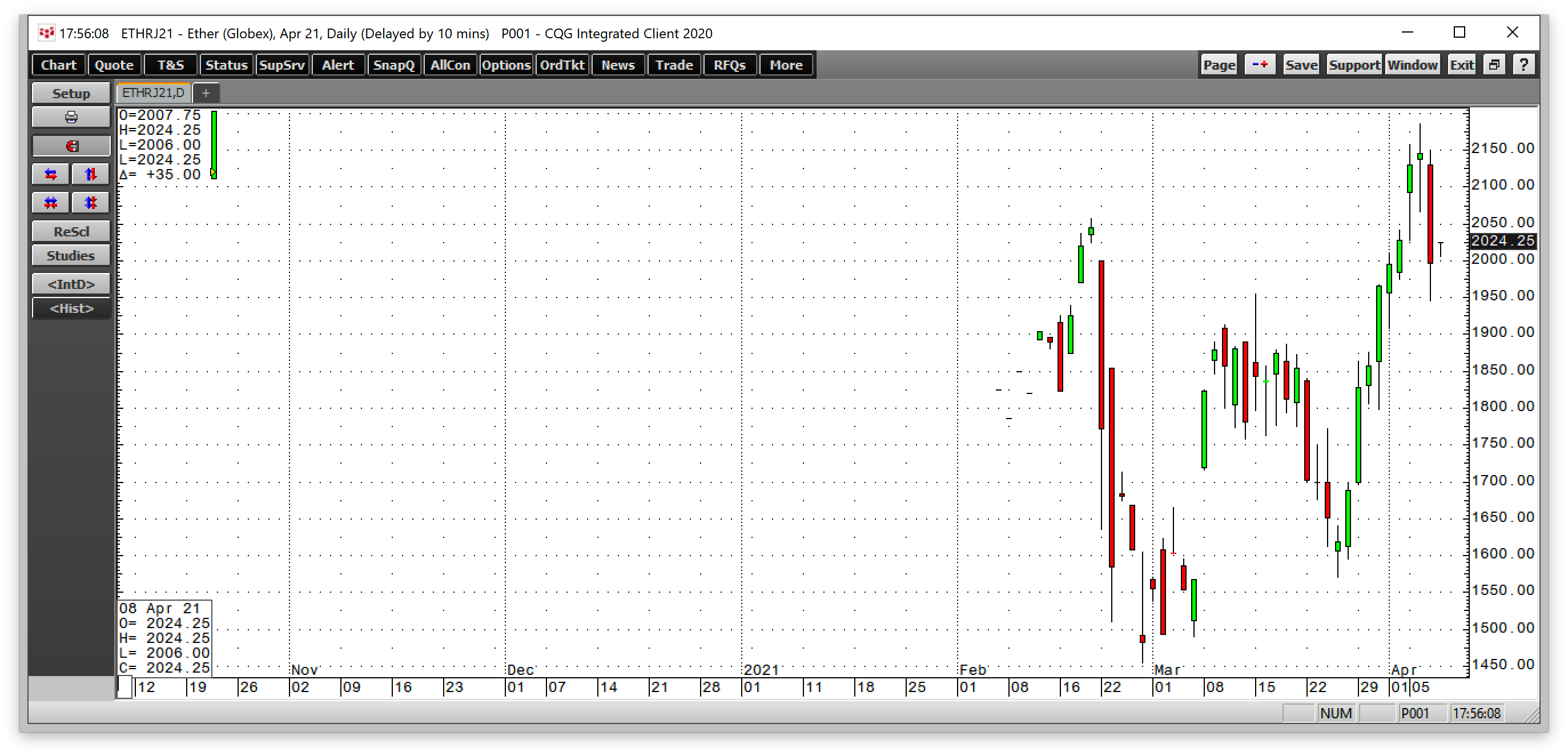

While Bitcoin made a new high, Ethereum futures rose to a lower peak in March after they began trading on Feb. 8. The introduction of futures pushed the second-leading cryptocurrency’s price to over the $2,000 level in February.

Source: CQG

In March, Ethereum peaked at $1954.25 on Mar. 15 and fell 19.7% to $1570 on Mar. 25. Ethereum was back at a new high of $2185.50 on Apr. 6.

Meanwhile, the digital currency market’s overall market cap of 9,162 tokens was just above the $1.9 trillion level at the end of 2021’s first quarter. The market cap rose above the $1 trillion level for the first time in 2021.

Bitcoin and Ethereum hold a dominant 67.9% of the total market cap. However, the percentage has been slipping, meaning the other 9,160 tokens are appreciating faster than the leaders.

Many of the tokens are nothing more than risky lotto tickets with low chances of return as the world does not have room for 9,162 liquid currency instruments. However, the top-tier digital coins that have built market caps and liquidity have the best chance of survival.

Bitcoin and Ethereum are large-cap coins. The mid-caps have values from $10 to $60 billion. As of Mar. 31, there were only thirteen mid-caps. Theta (THETA) and Filecoin (FIL) rank with the digital currency mid-cap tokens.

Theta: top-15 member of the asset class

As of Apr. 7, Theta was the eleventh leading cryptocurrency. Theta’s website describes the token as a decentralized video delivery network and a cryptocurrency. The platform offers technical and financial solutions for problems with the streaming sector.

Theta’s blockchain incentivizes sharing of bandwidth across the network. Theta users can contribute excess bandwidth and computing resources for the Theta cryptocurrency. Users can utilize the Ethereum ecosystem.

On Apr. 7, Theta ’s market cap stood at the $12.318 billion level, with the price at $12.31.

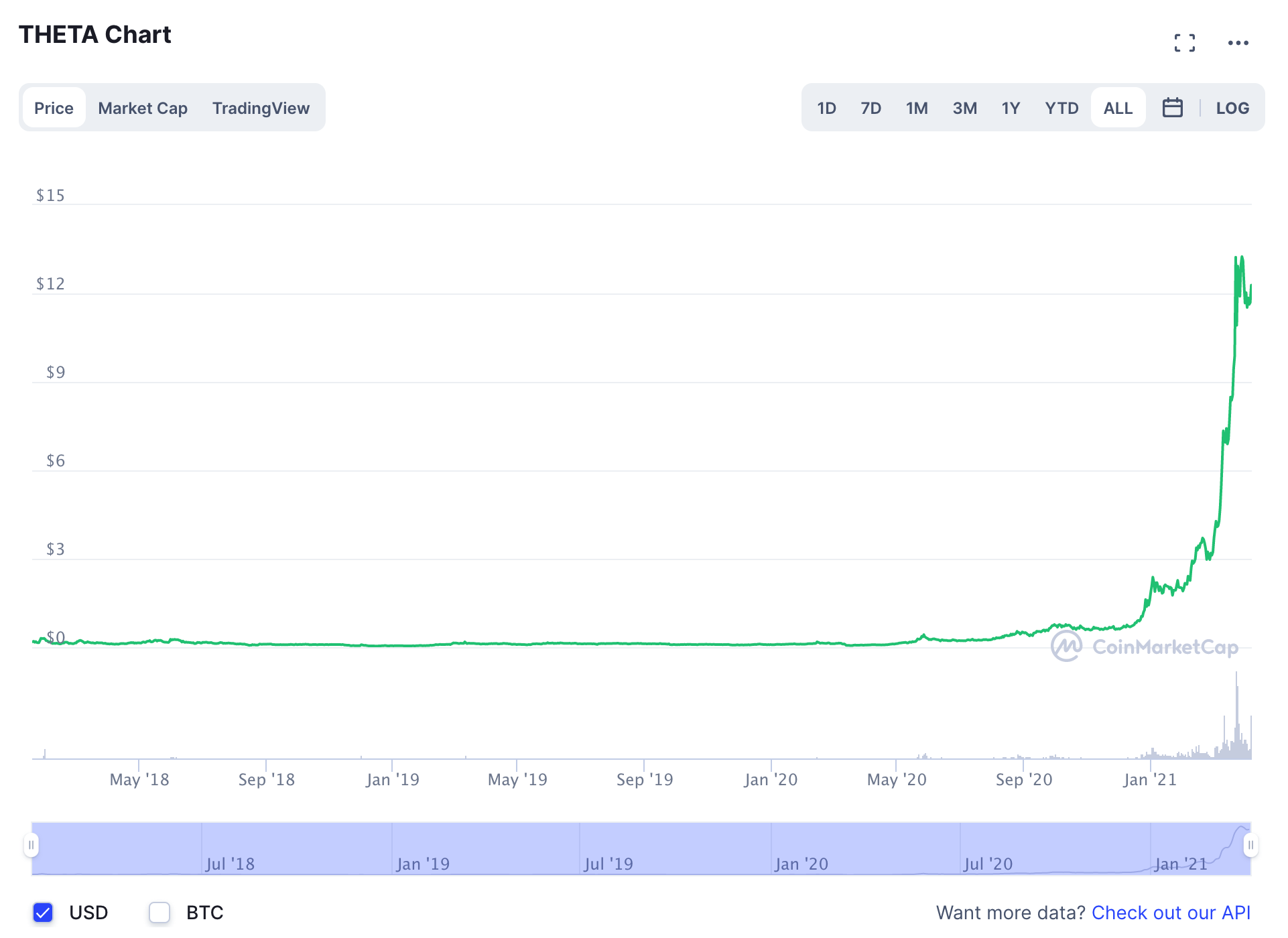

Source: CoinMarketCap

The chart shows the token’s range since 2018 from below 10 cents to a high of $13.25. It was sitting near the high on Mar. 31 and it hit a record peak on Apr. 7, 2021.

Theta has been climbing in the digital currency hierarchy as the token has outperformed many of the other over 9,161 cryptos.

Filecoin: in the top twenty

Filecoin is an open-source, public cryptocurrency and digital payment system that is a blockchain-based, cooperative digital storage and data retrieval method. Protocol Labs created Filecoin and builds critical mass on top of the InterPlanetary File System (IPFS), allowing users to rent unused hard drive space. Filecoin’s specs provide transparency for the cryptocurrency.

On Apr. 7, Filecoin ranked as the fifteenth leading digital currency with a market cap of $10.032 billion at $153.80 per token.

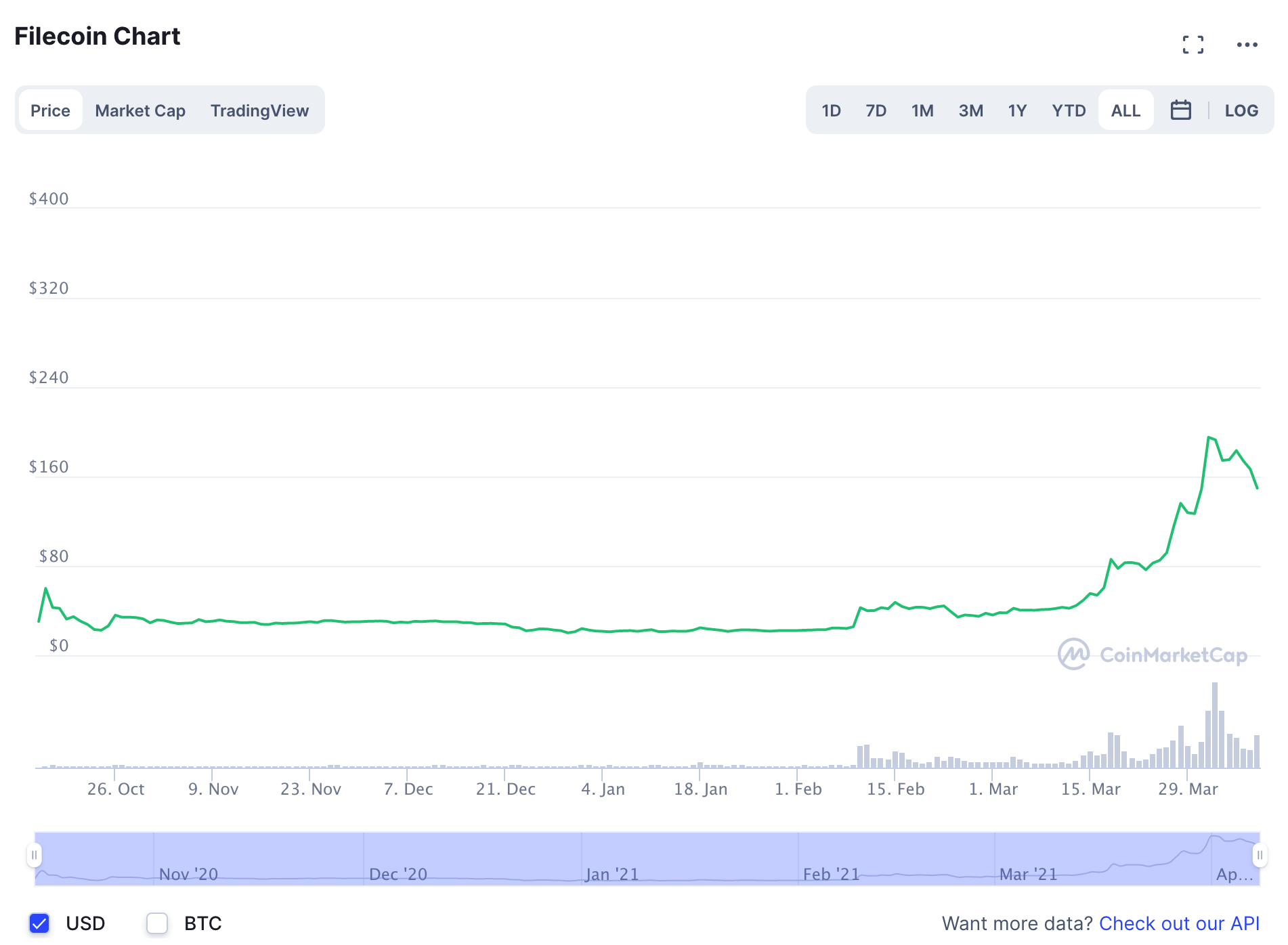

Source: CoinMarketCap

The chart illustrates the range of just over $20 to over $195 since October 2020, when FIL began trading.

Rising market caps build a critical mass for the future

Theta and Filecoin’s trends are bullish. The value of the tokens, their market caps, and where they rank in the asset class has been rising. Filecoin was below $24 per token in early February 2021. The price was over six times higher on Apr. 7. Theta was below $1 in late 2020 and experienced explosive growth over the past months.

The blistering moves in the top mid-cap cryptocurrencies with under $12.4 billion market caps established highly bullish trends. The trend is always your friend in markets, but risks of corrections rise with prices.

Theta and Filecoin have done extremely well at building critical mass in Q1 2021. The coming months will tell if the tokens can maintain the current pace of growth.

Look for diamonds in the rough in the crypto patch

I view the digital currency asset class as a field full of diamonds and landmines. With the thousands of tokens circulating in cyberspace, many are little more than landmines that will never reach the critical mass necessary to provide any returns for investors and could ultimately convulse into extinction.

As well, Bitcoin’s ascent means that percentage gains will decline, even if the asset class leader continues to move higher. Meanwhile, the emerging cryptos have the potential to provide exciting exponential returns.

When looking for diamonds in the asset class, liquidity is critical. Search for tokens with bullish trends in price and market valuations that are gaining in the market’s hierarchy. Theta and Filecoin qualify as two cryptos that have been diamonds over the past months.