Share this article

Holochain Digital Asset Report: Introduction

Holochain is a scalable, “agent-centric” distributed computing network. Unlike other decentralized platforms, the “consensus” engine utilizes a validating distributed hash table (DHT), requiring only nodes that are actually exchanging data with one another to reach a state of agreement.

As of Q4, 2018, Holochain is entering an important phase in the development of the project. An upcoming release of Holochain Rust Beta and sneak peak developer preview mark a moment when real development of hApps (dApps built with Holochain) can properly begin and growth of the ecosystem could take off. Uncertainty around the delay of the surrounding Rust Beta release is mitigated by tangible signs of development on GitHub and clear communication from the team.

The terms HOLO and Holochain refer to two projects that are, in effect, separate- Holochain is a generalized p2p framework for distributed computing- it has no fees, no platform, no currency- but is rather a pattern akin to html.

According to a discussion with the team, the driving motivation behind the creation of Holochain is the idea that people should be able to communicate in a direct and secure manner without relying on any 3rd party intermediary. As a result, there is no business model for Holochain itself, as the creators are giving it away for free.

However, giving Holochain away presents the team with two issues:

1. How to incentivize participants to join the ecosystem if they want to achieve growth?

2. How to accelerate adoption of the framework on a wider scale?

To solve these key factors, the team established HOLO, a p2p web hosting company. When an hApp is created and released to the public, anyone who downloads it can use the app and act as a peer among other app users.

HOLO enables that community to invite visitors who aren’t contributing their computing power to utilize the app for its specified purpose.

Simultaneously, network participants, such as developers or application providers, use HoloFuel to pay for the hosting power they serve to frontend app users.

The example of AirBNB serves to illustrate the model. Regular users want to book a room for without paying for use of the site, in line with the current paradigm. AirBNB uses, for example, AWS, which they pay to serve their websites to the rest of the world- Holochain enables that as well, instead through a marketplace of distributed hosts where people use their spare computing capacity to serve outsiders on their hApps.

To sustain the maintenance of this model, HOLO, the organization, receives a 1% cut of all transactions, 50% of which goes to support the development and maturation of Holochain. HOLO, therefore, acts as a means for members of the hApp to serve websites or applications to anyone outside the network, without being a peer.

Initiation Report Summary

- Holochain is a unique project in the cryptospace that offers an alternative to the data-centric blockchain paradigm where consensus is not at the center of the network

- Major questions exist regarding the ability of the network to compete with established blue chip players as the primary value proposition rests with provision of decentralized hosting resources which will be difficult to offer for a lower price than existing players

- The real value proposition of Holochain can only be realized with the timely Q1 release of the most crucial tech components, and more than likely the support of a major enterprise to compete in the highly-saturated distributed hosting market; the project retains an above average level of risk as it stands at a crossroads.

Part One: The Business Case

Holochain Market Opportunities

HOLO has set sights on becoming a large-scale player in the cloud computing market. To capture a piece of that market through a decentralized play, the project aims to solve two major issues preventing p2p web hosting from becoming the norm.

Traditionally, blockchain-based approaches to web hosting require hosts to store high loads of content on a device- in the instance of a decentralized Facebook, it would be unrealistic to expect a small group of nodes to accomplish this. In the case of Holochain, when a host device is queried, other members of that community supply the photos, etc. all packaged as an html file, so you don’t have to have the entirety of that app and all its data on a single device. This approach is similar to what cloud computing companies already do – except those machines are all behind one shop’s door instead of distributed across a network.

HoloFuel is incorporated to solve another purported problem for p2p web hosting- transactions and fees; historically, making payments on decentralized networks has been expensive. Paying a host 1/3 of a penny doesn’t make sense if the transaction fee exceeds the micro-payment.

In the crypto world, the accounting cost more often than not outweighs the worth of whatever dApp is being utilized (see almost any ETH based dApp at the moment); HoloFuel enables members of community to produce microtransactions without prohibitive costs, by storing transaction data exclusively on nodes that have an interest in interacting with one another, rather than across a global chain.

As a “framework for the distributed web”, HOLO has a protocol layer to build dApps (Ethereum), scalable distributed computing (iExec) and utilizes a non-blockchain-based means of achieving agreement between parties (Hashgraph).

While there are no direct comparison points to Holochain in the cryptospace, the above mentioned projects represent the most prominent ones that maintain a level of overlap on particular functions and use cases. The most prominent competitor on the protocol level is the Ethereum network, as both projects provide platforms for the development and deployment of decentralized applications (dApps).

Further, the Ethereum network plans on implementing both sharding and plasma (dApp-specific side chains), creating a functionality that is in some ways similar, but not the same as, the distributed hash table (DHT) model employed by Holochain.

The successful deployment of Plasma and sharding on the network in 2019 not only represents a significant threat to HOLO, but a number of other high-throughput focused protocols, though the exact timing of the launch still remains an unknown factor.

Hashgraph represents a large-scale competitor in the cryptospace for Holochain as a decentralized platform for building and hosting dApps that utilizes hash-chains. Hashgraph incorporates the use of secure hash-chains and directed acyclic graph (DAG) tech, in addition to other features shared with Holochain such as a focus on application-level data integrity.

The most obvious point of differentiation is that Hashgraph still is designed to achieve global consensus across the entirety of the network and relies on one specific route to consensus for doing so. In essence, Hashgraph proposes a data-centric model with the goal of reaching global consensus; conversely, Holochain proposes an agent-centric model where nodes act independently and or in coordination with local actors.

While there is overlap and potential for competition in the dApp space and incorporation of similar means for carrying out transactions in a distributed manner, the projects do not represent a direct threat to one another in the short-term, as Hashgraph has taken aim at initial deployment scenarios that are more suited to networks geared toward global consensus, such as cross-border transactions.

The most analogous network in terms of functionality and use case in this sense would be iExec, an open-source platform where dApps can utilize on-demand cloud computing infrastructure through a secure p2p network built on the Ethereum network.

Similar in a sense to Holochain, there is a great degree of latitude in terms of availability of functions offered by iExec, such as Software as a Service (SaaS applications), web hosting, data management, and other infrastructure-related products. However, iExec does not offer the full developer suite along with access to services, instead relying on Ethereum for this.

Were iExec to generate significant development on the network in time for higher throughput levels on the Ethereum network, the project would stand a chance at greatly benefiting from its reliance on the network.

Furthermore, iExec’s plans for serving regular dApp users with no knowledge of the cryptospace remain unclear. With HOLO’s plan for DNS integration, hApps have the ability to serve anyone with a browser, with no need to connect to a network such as Ethereum.

At this stage, as HOLO offers developers a one-stop-shop for development of dApps and provision of related hosting infrastructure along with DNS integration, though formidable, the moat still remains open to make a foray into this market.

While both Hashgraph and Holochain differ in their initial target markets, if both ecosystems see solid growth over the next year, the $100 million dollar raise conducted by Hashgraph offers a much longer runway and pool of resources for the project. With 10% of 50 billion tokens expected to be in circulation within one year, at ICO price ($0.12) this implies a $600 million valuation.

When it comes to sheer amount of resources available to Hashgraph (the same story for Ethereum) and network effect, Holochain faces an uphill struggle for raising brand awareness and converting users once the network is fully useable. This represents a significant threat to Holochain as a much lower-cap project as 2019 approaches.

Competitor Comparison – Emerging Tech

According to Director of Communications, Matthew Schutte, HOLO ultimately aims to become the largest distributed cloud computing company on Earth as a p2p web hosting provider.

With the level of competition from existing players in the cloud hosting space offered by centralized services at highly competitive prices, this ambition is by no means an easy task. With the cloud computing market projected to reach a value of $411 billion by 2020 (including Software as a Service, Platform as a Service and Infrastructure as a Service markets), the project’s ability to capture a small piece of the market of users who value decentralized alternatives to centralized hosting infrastructure is absolutely crucial for the long-term value of project.

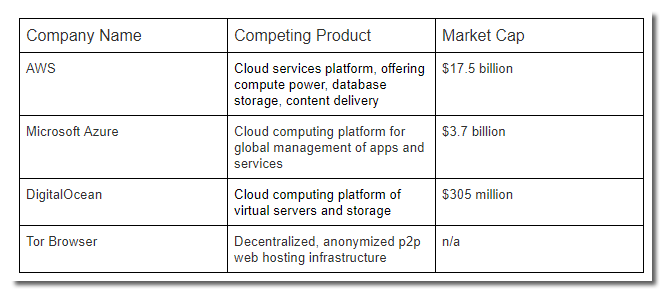

However, HOLO has not yet exhibited evidence of the project’s ability to achieve that end. An example of some competitors in this realm are provided below.

Competitor Comparison – Mature Tech

The most pressing threat to HOLO is the ability for established industry giants with consistent revenue and an established user base. With scale comes the ability to compete on price- an issue HOLO has highlighted themselves from the start.

When comparing HOLO to AWS for example, the primary differentiation is that HOLO distributes hosting services throughout the network, much in the same way as TOR, but for a cost that will be higher than AWS from the get go (rather than free like TOR).

For the network to compete at any meaningful level with centralized services, an enormous amount of HoloHosts, along with owners of HoloPorts (the premade hosting hardware offered by HOLO for providing hosting services on the network) would be required to reduce hosting costs.

Although the project initially sold around 2000 HoloPorts, HOLO plan to offer HoloPorts for sale again in the near future, which would help facilitate ease of hosting on the network; but the prospects for a future market of HoloPort buyers rests on the quality of the hApps on the network itself, which have yet to be proven.

As for any shot at truly competing on a commercial level anywhere close to that of centralized hosting providers, the much touted rumors of a partnership with Mozilla offer one of the only conceivable routes to such a position through provision of additional infrastructure and integrated use case scenarios.

On the performance end, while HOLO plans to offer DNS integration, the network will also likely face issues with latency and uptime on the hosting end, especially in the beginning phases. While HOLO maintains a mechanism through HoloQuery for boosting the most reliable, fastest hosts in the DNS cycle, this remains an untested solution and will face challenges in competing with the reliability of centralized services like AWS, Microsoft Azure, IBM Cloud and even smaller-scale, semi-open source enterprises like Digital Ocean.

These issues around cost and performance place HOLO at a significant disadvantage from a regular consumer standpoint, and, at least in its present form, make any likely future prospects for the project appear more akin to a crypto-based TOR than a decentralized competitor with centralized hosting providers with billions of dollars in annual revenue.

In August, Holochain engaged in preliminary talks with Mozilla. With the results of these talks expected sometime before the end of the year, the implications of any major cooperation between the two organizations could be a potential game-changer for HOLO when it comes to competing at commercial-scale among decentralized competitors, save Ethereum.

A Mozilla partnership would provide additional financial resources, a boost in market awareness of the project to a broader base of consumers, and likely produce a positive effect on the value of the token, giving the project more time to grow.

Moreover, from a technical standpoint, a partnership with Mozilla would act as a tacit endorsement of the underlying technology over competitors, lending the weight of a huge name in the IT industry behind the value proposition of the project.

While the effect would certainly be positive for HOLO, Mozilla is likely most interested in the underlying tech the project has to offer and what future applications might be developed from that.

Whether a potential partnership eventually translates into a direct benefit to the HOLO ecosystem or not is no guarantee. For now, however, this variable remains almost entirely under wraps and is highly speculative.

Ecosystem Development

Network Participants

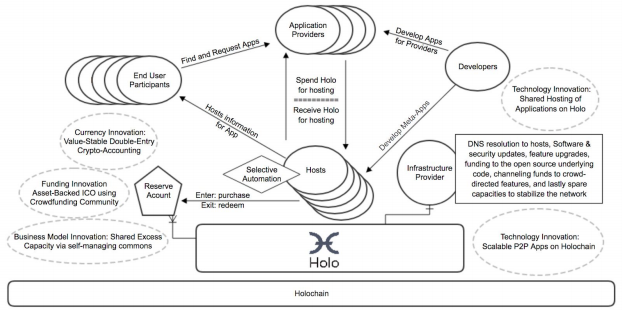

Hosts – The HOLO ecosystem relies on hosts that provide processing power and hosting for distributed applications while earning redeemable credits. Hosts choose which apps to serve, setting their own priorities and filters according to app categories, price brackets, and usage demands.

Application Providers – Application Providers are responsible for the maintenance and security of apps they publish on the HOLO marketplace. They also agree to timely payment of Proof-of-Service invoices. Since unpaid invoices are visible to all, it is easy enough for a Host to demonstrate a failure to pay. No central authority needs to intervene, and no smart-contract needs to enforce payment. Besides receiving payments in HoloFuel, if apps take payments in other currencies, they can use their revenue to purchase additional hosting credits from HOLO Reserve Accounts.

End User Participants – An end-user accesses crowd-hosted applications via standard web browsers, so their defining characteristic is that they have not installed Holochain. Holo is designed to help such end-users reach their applications and make it easy to conduct crypto-transactions. End users can participate to various degrees on hApps depending on the rules established by each respective hApp in the ecosystem; no HoloFuel is required if hosts or app providers deem it so, or, the end user participates within the parameters of a pre-established net positive balance

Developers – Participants who develop hApps for Application Providers within the ecosystem.

Infrastructure Provider (aka HOLO) – The Holo Application Delivery Network manages bridging from the web to Holochain. With the support of Reserve Accounts, it also provides the backing for the asset-backed, mutual-credit currency and manages value flows between ecosystem participants, including allowing Hosts to convert HoloFuel to other currencies.

HOLO holds HoloFuel in reserve to ensure there is substantial liquidity for conversion to other currencies. HOLO will initially provide the sole Reserve Account in the network, which the team has stated will be run in a transparent manner, demonstrating proof of funds, in addition to the ongoing receipt and disbursal of funds.

Holochain Ecosystem Diagram

Ecosystem Participants

To drive organic growth of the network, the team have provided hands on support for developers building with Holochain, establishing “office hours” when they can communicate with Holo engineers directly.

The team has also launched an open source app for communication with the team and community. Three online dev camps are also planned between November 2018 and January 2019.

A look at the Holochain Hackathon calendar shows around nine meetups since September until present, in locations that include Cyprus, Amsterdam, Barcelona, São Paulo and, NYC.

The timing and effort by the team to foster growth of the developer community both globally and online is a prudent step in maximizing the number of hApps that result from the upcoming Beta release – the results of such efforts though, are far from quantifiable at this phase in the project’s development.

While HOLO is exerting efforts toward sparking development and has seen some ICOs (OurWorld, Promether, ProducersToken) develop on the platform, there is not yet much in the way of tangible signs of an ecosystem, as the project is still in its early stages.

iExec, on the other hand, has already achieved visible progress on this front. Extensive development of the iExec ecosystem has resulted from the network’s first mover status in the space. An alpha version of the marketplace is already available, similar to the forward facing marketplace planned for release by HOLO next year.

First mover advantage does not guarantee prominence over the entire target market if iExec cannot develop an ecosystem of dApps that are actually utilized at scale, but at this stage it remains too early to make a definitive call – however, if we use the $15 million valuation of iExec (in comparison to the $130 million valuation of HOLO) as a gauge for investor sentiment toward future prospects of both projects, HOLO comes out on top.

Decentralization

Holochain does not maintain a traditional governance model for establishing network parameters, as the agent-centric model allows for disparate forms of decision making within an open framework.

From the perspective of a network participant, this gives the project a much wider degree of flexibility that could prove attractive to developers and end users alike.

However, the supporting organization, HOLO, receives a percentage of transaction fees, which has been criticized for its potential to centralize a substantial amount of authority with one organization. The team argue that this model is necessary for continued funding of network maintenance, in addition to backing whatever hosting power is provided by the organization itself with HoloFuel, which should help stabilize value.

Regardless, despite introducing a new model of governance on the user level, the overall ecosystem is subject to the indisputable decision making power held by HOLO over network updates, which is arguably analogous to that of any developer team behind large crypto-projects like Bitcoin or Ethereum; but with no viable way to fork the network as HOLO maintains the infrastructure for DNS services.

This structure presents another downside to the project and makes HOLO as a whole much less decentralized than it first appears.

When it comes to the question of nodes accumulating large enough amounts of HoloFuel to destabilize the price, the framework also holds potential flaws. While a mechanism for DNS rotation exists so that traffic is delegated to hosts according to statistics stored on the DHT (such as activity from gossip protocols, percentage of uptime, latency, and bandwidth speeds), this does not stop a number of “super” hosts from accumulating enough computing power to centralize large sums of HoloFuel.

How HOLO would deal with such a scenario remains unclear, despite the fact that the risk persists at all conceivable stages of development, from initial deployment to a large-scale network.

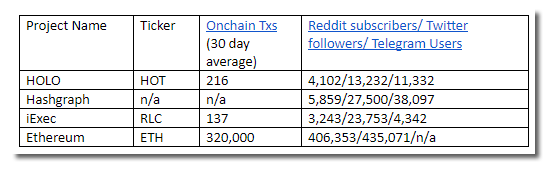

Ecosystem Comparison

While Holochain attracted quite a lot of attention for its unique take on decentralized networks upon its introduction, user engagement is only on par with iExec and comparatively low with Hashgraph.

The upcoming release of the Rust Beta and deployment of HoloPorts/HoloHosts in Q1, if on time, could provide a much needed catalyst to launch awareness, support and adoption levels ahead of iExec.

Holochain still retains a strong support base among the project’s community, which could serve as an important springboard for the network in the beginning of 2019. The question remains- how will community growth efforts serve to grow these figures that can drive adoption at mass scale on a comparable level to top protocol tokens? Anything short of the success for these upcoming milestones will likely close the moat for Holochain, so hitting milestones on-time in Q1 remains critical.

Token Economics

HoloHosts who offer their computing resources to hosting the distributed web are rewarded in “credits”, called HoloFuel. Developers that want to host their hApps pay for hosting using HoloFuel.

Prior to launch of the network, however, Holochain has released HoloToken (HOT), an ERC-20 representation of Holochain’s own resource power, which serves as a temporary coupon exchangeable for HoloFuel.

With the introduction of HoloFuel, Holochain will attempt to achieve a certain degree of price stability because the credits are, in theory, a means of transacting value backed by a real asset; i.e. computing power.

As more hosts come online and share computing power, the network becomes more valuable, giving each individual credit more purchasing power in relation to the service they are designed to support.

As the price of computing goes down, each unit of HoloFuel will buy more computing power, meaning users can accomplish more with the same amount of credits; the model is designed so that at a certain point, the price of HoloFuel settles at the cost approximate cost of providing hosting services in a distributed manner (which will in all likelihood remain above that of centralized providers).

Asset Distribution

The price structure of HOT during the ICO was set at a calculated margin high enough from where the team predicts the it will settle to encourage early participation in the marketplace and reward early supporters.

Early investors and hosts theoretically receive far more value for their purchase as the market reaches a more competitive price point, contingent upon the sustained growth of the ecosystem.

As an early host on the network, if a host provides 10GB of hosting power from the launch of the network, later on, that same HoloFuel earned as a reward could be worth 1TB of hosting power if demand continues to grow.

As an early stage project with no real signs of ecosystem development yet, long-term investors going in on the project are making a wager that this ecosystem will grow to a large enough level that the asset-backed economics underlying HoloFuel bring real returns.

What happens in the theoretical scenario that demand for hosting rises, driving the price of HoloFuel up?

In such a scenario, high-reputation Hosts can issue their own HoloFuel, backed by a level of credibility established through a track record of low latency and high uptime; this, in turn, creates a downward pressure on the price. Since hosts won’t offer services at a price lower than operating costs, the system is in essence anchored by the cost of hosting.

If hosts themselves leave the network and supply of HoloFuel drops, upward price pressure should in theory attract new hosts, again raising supply of HoloFuel and bringing the price down.

In this sense, the economics are fluid, allowing for a quick response in the price of HoloFuel to any fluctuation in demand for hosting power.

However, two problems arise from this scenario- use of HoloFuel is not imperative to deployment of hApps on Holochain. While HoloFuel is required for provision of DNS services to mainstream users of hApps, it is not needed for anyone to build their own p2p system on Holochain.

This is important for long-term value, as any developer or application provider aiming to build a product on the network for use among regular users on browsers will require HoloFuel for hosting, driving demand for hosting if attractive enough hApps exist to pull large numbers of users into the network.

Secondly, the ability of Hosts to issue HoloFuel when demand rises in proportion to supply will always act to counter any significant rise in value, limiting the amount of returns for holders of HoloFuel.

At this stage, the primary driver behind the price of HOT is speculative. However, Holochain stands at an important crossroads where the release of the full Beta Rust to the wider developer community, planned Q1 2019 distribution of HoloPorts, and launch of the p2p web hosting marketplace for non-Holochain peers to access hApps, will establish the groundwork for the token economic model envisaged by the team that is based on real hosting power.

The more adoption that occurs within the coming two quarters, the more demand for hosting power will occur, which will become the major force behind the price of HoloFuel.

The early stage nature of the project, however, means investing in the stand-in token, HOT, will be subject entirely to speculative forces and market sentiment for the time being.

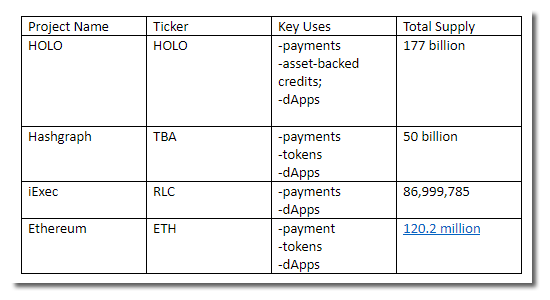

Token Comparison

In comparison to competing projects, HOLO has the biggest total coin supply. While the HOLO organization’s economic model for fee collection is based on the idea of stabilization, a high concentration of assets by the organization and large-scale Hosts still leaves HoloFuel open to inflation events if the currency is not managed responsibly.

Because the token is inextricably bound to hosting hApps on the network accessible to everyday users, and Hosts can set their own price for provision of computing resources, the potential for a relatively high ratio of utility demand for HoloFuel to support the price once the network is in operation is only achievable with a flourishing ecosystem, which remains a ways down the road.

Lead Team

Project Founders

The Co-founders of Holochain are Arthur Brock and Eric Harris-Braun. Arthur serves as Chief Architect, while Eric Harris-Braun fulfills the role of Executive Engineer.

Arthur Brock is the Founder and Systems Architect of the Metacurrency Project, which he founded in 2008. The MetaCurrency Project involves the design and deployment of multi-currency platforms with a broad range of configurability for different currency solutions, and eventually led to the Holochain project itself.

Between 2003 – 2007, Arthur worked on another currency-related project, Targeted Currencies Network, where he served as CTO and Lead Currency Designer. Arthur led initiatives targeting the development of alternative currency systems for a diverse array social and economic issues. Having made his foray into the world of alternative currencies as far back as 2003, Arthur has extensive experience in the space.

Eric Harris-Braun is a Co-Founder of the MetaCurrency Project as well. In 1993, he founded Glass Bead Software, a cross-platform p2p communication company that is still in existence at present and has provided him with ample know-how in engineering distributed networks. He has served on the boards of both the New Economics Institute from 2004 to 2013 and has continued on as a board member with the Schumacher Center for New Economics since 2013.

Most notably, both Arthur Brock and Eric Harris-Braun have been in the alternative currency space longer than most teams in the cryptospace. Arthur’s experience with alternative forms of currency dates back 15 years, and has given him firsthand experience experimenting with usage of various forms of asset-backed means of value exchange.

Team Composition

While this is not the Co-founders’ first foray into creation of a currency or asset-based economy, the extent of their previous efforts never reached large-scale proportions. This is not to detract from the competitive advantage such experience brings to Holochain, but serves to underscore the need for a marketing wing that is capable of bringing awareness of the project to a level that makes a mark in the wider crypto community.

When it comes to awareness, the community support indicators reflect this need for more efforts to support awareness of HOLO.

Compared to Ethereum, support for HOLO is several orders of magnitude lower in number. Out of 31 core team members, around 7 are dedicated to community building, forging partnerships, and “coordinating” people and culture.

For the project to compete on the scale envisaged by the team, the human resources devoted to expanding use of the product will inevitably require a sizeable increase in skilled personnel.

Part Two: The Technology Case

Underlying Technology

Consensus Mechanism

Holochain provides cryptographically secured data integrity for decentralised p2p transactions without using consensus. Data integrity is ensured on hApps through establishing provenance of data published from each agent’s local, immutable chain.

In other words, HOLO focuses on p2p coordination without relying on 3rd party web servers, something blockchain could achieve if ordinary users had the capacity to maintain a full record of global consensus on a typical home computer or mobile phone. Public entries are then shared to a content addressable DHT, with cryptographic signatures, enforcement of data schemas, and application logic by randomly selected peers.

With Holochain, each different dApp scenario can establish unique parameters for the level of provenance required among peers. To illustrate this, the rules for a Holo Twitter would likely differ from an hApp for transfer of assets, as the risk associated with the latter is much higher.

One way to ascertain this critical difference is to look the implications of this model from the perspective of users: whereas data-centric approaches like Hashgraph prioritize reaching consensus across the network, Holochain prioritizes the information contained within the hash-chain of the user, and only seeks to achieve consensus between those agents who require it.

The flexibility and scalability offered through the use of DHTs will open up a plethora of use case scenarios immediately upon deployment of the network which will be untenable for the time being on traditional-blockchain networks due to the oft-repeated bottlenecks surrounding network overhead.

As pointed out in our Holochain code review, this architecture especially lends itself to p2p platforms, social networks and collaborative work scenarios.

As a proof-of-concept for ease of ecosystem expansion, HOLO has already developed HoloChat, a multi-room P2P chat platform similar to a distributed Slack, and Clutter, a distributed version of Twitter, which can already deployed on local networks using Holochain.

iExec, by contrast, remains strongly limited by its reliance on the Ethereum network, and will remain this way until sharding/plasma is implemented. While iExec theoretically aims at becoming blockchain agnostic and partnered with the likes of Rootstock (RSK), no signs of development of an ecosystem are visible to this end. In fact, while iExec was a first mover in the distributed cloud computing space, the network limitations posed by Ethereum leaves open an important moat for HOLO to take advantage of in Q1 2019.

Security

Holochain establishes a level of security on each hash-chain through the use of “DNA”, which effectively acts as an application specific contract. Like all user roles, major rights and responsibilities involve following the rules encoded in the HOLO app DNA and anything that would go against an applications DNA structure, changes the hash of the block, and effectively forks the user into his or her own private malicious chain, unable to affect anyone else.

This provides an additional functionality advantage over iExec, which aims for network-wide consensus and would stand to hinder performance until Ethereum implements a scaling solution.

By and large, users are incentivized not to defraud others on the system with the understanding that when they are caught all privileges on HOLO may be revoked (referred to as an “immune system response” much like the reaction of an organic organism against malignant cells).

On Holochain, every communication and element of data is signed by its author to their individual immutable chain (or it won’t propagate). If a participant acts maliciously, their actions are published on a non-repudiable record, akin to digital fingerprints that result in rejection of the next transaction. In the case of collusion, the first actor that witnesses this behavior alerts other nodes. The node which notices the collusion alerts others as well- a distributed enforcement mechanism moves to take action by refusing to engage with those nodes on the network.

This is the basis of the “immune system,” as any node can create a “warrant” that flags fraudulent behavior and provides the original signed records of the malicious actor as proof. Warrants can then spread as proof of fraud, so other nodes move to blacklist colluders.

This app-to-app approach to security stands in sharp contrast to the monolithic approaches deployed by iExec and Hashgraph which apply across the entire network.

For developers and users alike, the advantage here is that not all dApp scenarios will require the same level of security, so app builders are free to choose, and users to vote, on what rules they will follow.

In many ways this is structure represents a radical shift away from the current network-wise paradigm that could serve as an attractive alternative for future projects, as it embodies a level of flexibility that is unparalleled among crypto-projects to date.

Pace of Development

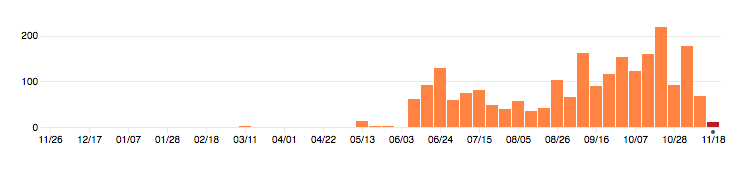

A look at the commit activity on GitHub activity shows development of Holochain Rust has steadily risen since the week of August 12th (34 commits) up to the week of October 21st (219 commits). From the week of October 28th onward, less development activity is reflected in the number of commits. Between the period of October 19th – November 19th, 11 developers have pushed 614 commits to develop and 666 commits to all branches.

Considering the numbers overall, it is fair to say development on Holochain Rust is highly active, and with it, there is reason to believe an imminent release that includes the network stack is indeed a possibility.

As Hashgraph has not made development progress publicly available, it is impossible to judge precisely at what stage the project stands in comparison to Holochain. In the case of iExec, during the same period from October 19th – November 19th, the project has had 4 authors push 30 commits to master and 30 commits to all branches. Progress on iExec is demonstrably lower in comparison at the moment, but the project still maintains a lead position in comparison to Holochain in terms of where product development currently stands. Come Q1 2019, that position could shift in favor of Holochain.

Holochain GitHub Commits

Holochain GitHub Commits

The Hedera Hashgraph Platform will initially support smart contracts written in the industry standard coding language, Solidity, arguably giving the platform an advantage over contenders like Holochain and iExec, which rely on WebAssembly and Javascript respectively. Like Holochain, Hashgaph also has an API for mobile and desktop devices, which can be programmed in any language and opens up a plethora of use case scenarios.

Roadmap

Holochain updated the project roadmap in early August with revised milestones. Below are the main project milestones from the original roadmap, followed by the updated version.

Original Milestones

- Q1 2018: Holochain GO Alpha 1 and Clutter release

- Q2 2018: Alpha 2 release, Holo Alpha made available to Indiegogo supporters

- Q3 2018: Alpha 3, including security audit and introduction of DHT parameter adjustment, HoloPorts shipped to hosts, first test transaction on Holo using Holo fuel

- Q4 2018: Beta release, App Store launch, 50+ hApps launch, partnerships established with projects launching other asset-backed currencies, testnet of Holo on 10,000 host devices

Updated Milestones

- Q3 (August) 2018: Holochain Rust Alpha 1 release

- Q3 (September) 2018: Holochain Rust Beta 1 release, Holo Pre-Alpha made available to Indiegogo supporters who contributed to first raise pre-ICO

- Q4 (October) 2018: HoloPorts ship to investors, Holochain Dev camps

The latest roadmap initially had the Alpha 1 Release of Rust scheduled for 2018. Holochain has already released several pre-alpha and alpha iterations, most recently the May 26th Alpha 0.1 (Scout) in Go language. After May, a decision was made to shift to Rust.

In a discussion with Matthew Schutte, Director of Communications for HOLO, he outlined several reasons for this shift which contributed to a delay in the Holochain Rust Alpha 1 release.

First off, Rust supports mobile devices, meaning Holochain will support full nodes on cell phones through WebAssembly.

Secondly, Rust will better enable support for more diverse configurations of hApps, which is a primary aim of the project.

Finally, the GO version of Holochain made use of Libp2p for IPFS networking between peers, but did not enable the level of functionality the developer team requires for particular roadblocks like punching through firewalls. While the shift makes sense in terms of capturing a broader market and increasing functionality, HOLO inevitably lost precious goodwill by missing their earlier scheduled launch.

On October 31st, Holochain released the second iteration of the Rust rebuild, which is effectively the first part of the Rust Beta 1 release- the team have dubbed this the “Developer Preview Prerelease”. With the prerelease, Holochain is limited to local-node actions only, with the networking stack still under development. While commits can be made to a local chain and published to a local DHT, the ability to connect with other nodes is still absent.

With the developer preview release, developers can gain begin building hApps with the latest version of Holochain, and now have the ability to both run apps locally and build UIs, putting Holochain within close reach of crossing the crucial milestone of the network stack launch.

The API is aimed at jump-starting development of hApps before the network comes online, defining a constructive step forward in enabling real growth of the ecosystem.

Importantly, the Rust version of Holochain uses a WebAssembly interpreter for all Holochain DNA code, enabling developers to essentially utilize any programming language that is WebAssembly compliant for hApp development.

Development of the network stack itself is underway and is planned for release in Q1 2019, meaning hApps will be able to connect to other nodes across the network.

The shipment of HoloPorts to investors has been postponed until the beginning of 2019, from the original Q4 2018 milestone. It should be noted while HoloPorts were sold to ease the process for onboarding Hosts, they are not required for the launch of the network, but will nonetheless still play a critical role for expansion, especially if they prove a viable means of generating income.

Looking ahead, announcements that signal the full release of the Rust Beta, distribution of HoloPorts and finalization of the network stack could all serve as potential price catalysts.

With the level of work the team is currently putting into both development and ecosystem growth, delaying the launch past Q1 2019 would serve to stifle the current momentum of the project and have a highly negative impact on the future of the project.

Part Three: The Investment Case

HOT Token Performance

Daily Price Change

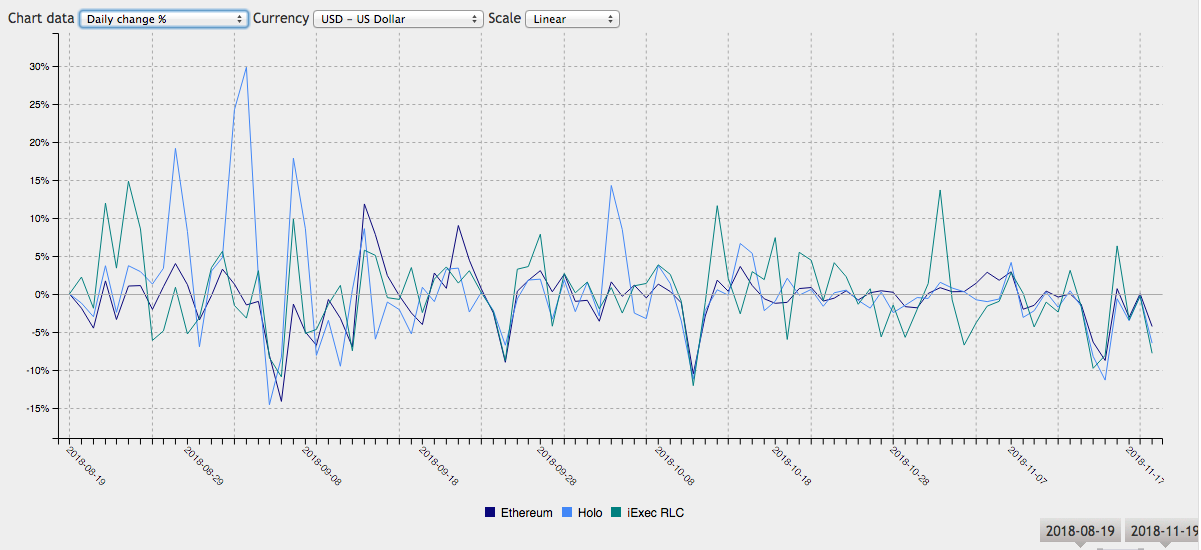

A comparison of daily price change of HOT against Ethereum (ETH) and iExec (RLC) from August 19th until early December reveals some significant divergence in the performance of the tokens over the preceding three month period, in which there were diverging periods when each token took a lead over the other in gains.

From the period of September 9th onward, HOT has largely followed ETH closely until December, representing much lower price volatility in comparison to RLC, which on October 13th achieved a 10% gain in price over Ethereum and on November 11th a 12% gain, both of which were short lived.

Daily Price Change Over 90 Days

Trade Volume

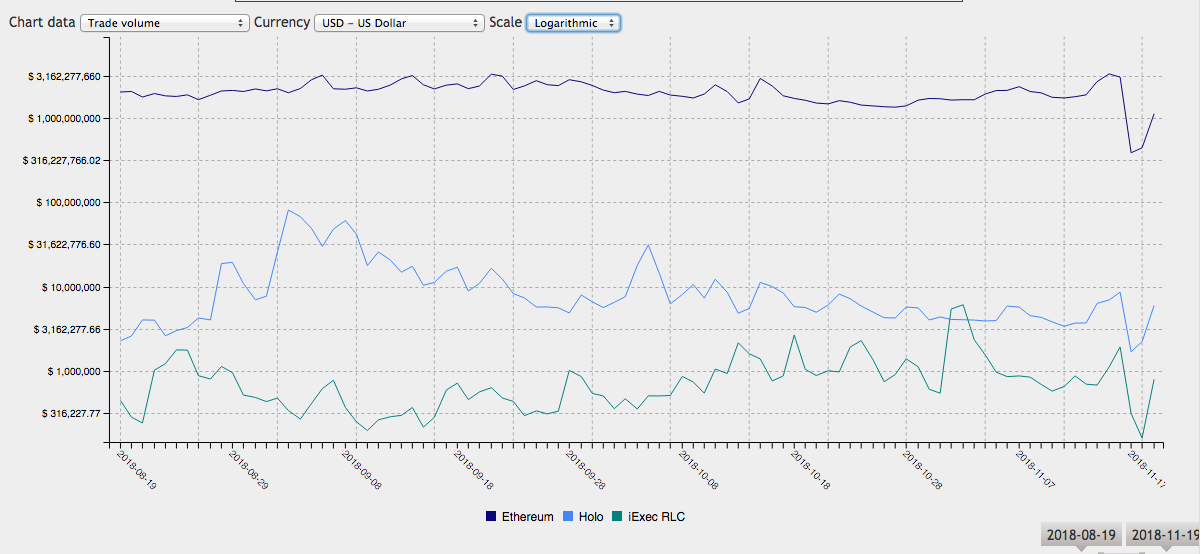

HOT has experienced several periods of fluctuations in trade volume over the preceding three month period, adding to the risk level associated with the project. In the same period, HOT fell from a peak daily volume of $81 million on September 3rd to the present mark at $6 million closing out November.

On November 1st, iExec daily trading volume managed to temporarily surpass that of HOT by $2 million, but has consistently remained below it, at times dipping into the six figure mark.

The steady downward trend of HOT volume, out of step relative to the rest of the market, may indicate a declining interest and sentiment from traders who are betting on the future success of the project. The downtrend in volume has also significantly reduced overall liquidity of HOT, making it more difficult to move in and out of positions.

Aside from the short lived frenzy around September 7th, where volume tripled to around $18 million, liquidity levels have remained consistently low. On November 17th, HOT experience a drop in volume in line with the rest of the market down due to BCH to $1.6 million, but has recovered slightly in the days that followed back to around $3 million in daily trading volume.

Daily Trade Volume Over 90 Days

Daily Trade Volume Over 90 Days

Base Trading Pairs

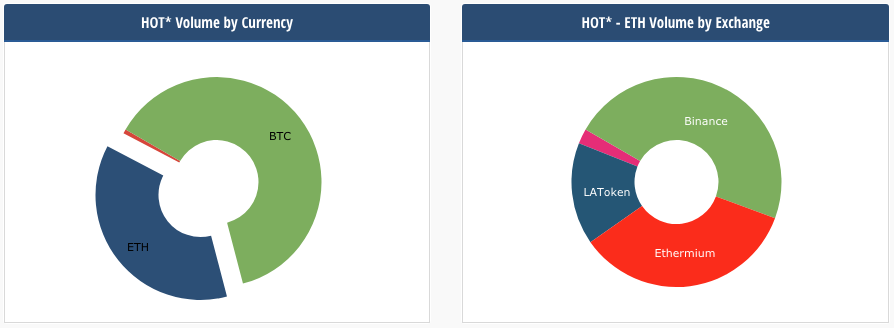

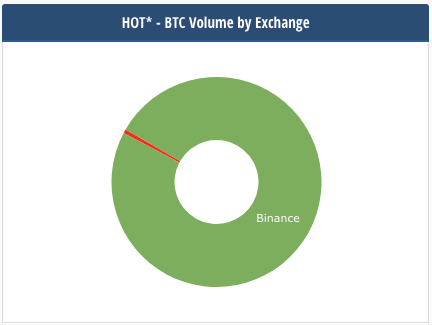

HOT volume by currency is almost entirely limited to BTC and ETH, with approximately 62% traded in BTC and 36% in ETH.

Outside of Binance, the lack of more well-known exchanges brings into question what level of real demand exists for the token. Further, trade volume in BTC is exclusively limited to Binance. Pairings with other tokens aside from BTC and ETH remain nearly non-existent, as is BTC trading outside of Binance, where the majority of volume by currency and exchange exists, exposing HOT to the vulnerabilities from trading on one major exchange.

Unless some sort of exclusivity agreement is in place, the lack of interest from other exchanges in listing HOT does not reflect well on sentiment toward real demand for the token from traders.

More live data and more information about Holochain can be found here.