Disclaimer: The text below is a press release that was not written by Cryptonews.com.

Every year the Financial Conduct Authority, also known by the somewhat ominous, FCA, undertakes a lengthy study on the relationship between cryptocurrency and its consumers … the 2021 publishing’s discovered something that shook the cryptocurrency world …

The FCA, in the entitled ‘Research Note: Crypto asset Consumer Research 2021’, published a host of interesting facts and titbits around consumer behaviour when it came to crypto, blockchain and the like … that after deeper digging seemed to translate across all blockchain-based technologies. From cryptocurrency to NFTs.

Though you’ll be shocked why the likes of Bitcoin ($BTC), Ethereum ($ETH), Shiba Inu ($SHIB), Dogecoin ($DOGE), Terra ($LUNA) and HUH Token ($HUH) (to name a few), are quickly becoming the crowning jewel in a plethora of investment portfolios. As well as, garnering adoption from crypto consumers who simply want to be a part of the 13-year long love affair with blockchain technology.

Let’s take a look at some of the findings from the FCA’s research paper to truly understand why the crypto craze is here to stay and how it’s becoming more widely used by the likes of traditional banking giants like JPMorgan, or why tech giants are opening virtual stores in Decentraland just as Samsung are.

This is the Formula 1 pit-stop for all things crypto consumption…

A Love Affair Through The Ages

Interestingly from 2019 to 2021, the most recent release of the FCA’s annual research, crypto is vastly becoming the preferred investment choice, as it appears that crypto lovers enjoy the thrill and the unpredictable predictability of the cryptocurrency market.

In fact, the FCA discovered that this was the number one reason for crypto investment and might have also been the cause of the general and wider spread of crypto awareness.

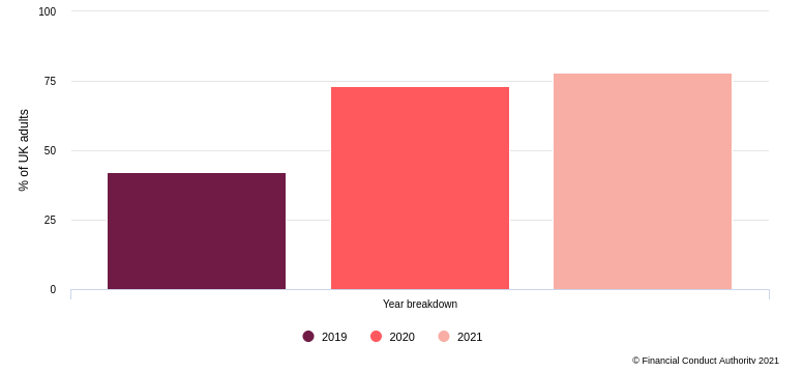

The chart below demonstrates the significant increase of those who had heard of cryptocurrency in a three-year period and, astonishingly, this number continues to rise as investors see crypto as a long-term investment for sustained windfalls, no matter how periodically this may occur, investors are certain the market will always rise from a dip. Just as the sun rises every morning.

The jaw-dropping realisations didn’t stop here, though the news of investors choosing to buy crypto was majority based on the cryptocurrency volatile market wasn’t a large enough gasp-filled moment, the research findings continued to shock and awe all that read them.

The FCA also found that not all crypto holders are whale investors, in fact, according to the research paper there was a number of crypto investors beneath $200, meaning that crypto is opening up, outside of the A/B demographic and welcoming a plethora of individuals from all backgrounds.

With the likes of Dogecoin ($DOGE), Shiba Inu ($SHIB) and HUH Token ($HUH), where the value of the currency can be a direct relation to how many holders hold the crypto, use influence and meme power to increase value … it’s no wonder that more people are becoming hip to crypto.

Not so shockingly, of the focus group, 57% of crypto investors said they’ve never sold their crypto and this might be because more crypto enthusiasts are holding or staking their currencies as crypto gains popularity as this could be set to spike crypto for thousands of people, if not more.

If you’re looking to be involved with the growing sphere of crypto you can visit the links below or visit the research page yourself that can be found on the FCA’s website.

Buy On HUH Website – https://swap.huh.social/

Buy On PancakeSwap: https://pancakswap.finance/

Buy On Uniswap: https://app.uniswap.org///swap

Website: https://huh.social/

Telegram: https://t.me/HUHTOKEN

Twitter: http://twitter.com/huhtoken