Bitcoin Analysis

Bitcoin’s price closed back above the 200W MA for the first time since June 6th to close a week on Sunday but failed to continue its momentum and concluded its daily session $-345.

BTC’s price did manage to close the monthly timescale back in green figures after three consecutive months of sellers pushing the price lower prior.

The first chart we’re leading off with to begin a new week is the BTC/USD 1W chart below from davy101. BTC’s price is trading between the 0.00% fibonacci level [$17,529.35] and 23.60% [$24,226.65], at the time of writing.

Bullish market participants have targets to the upside of 23.60%, 38.20% [$29,595.79], and 50.00% [$34,793.15].

Conversely, bearish BTC traders are looking to again retest 12-month lows on BTC and a full rectracement at the 0.00% fib level.

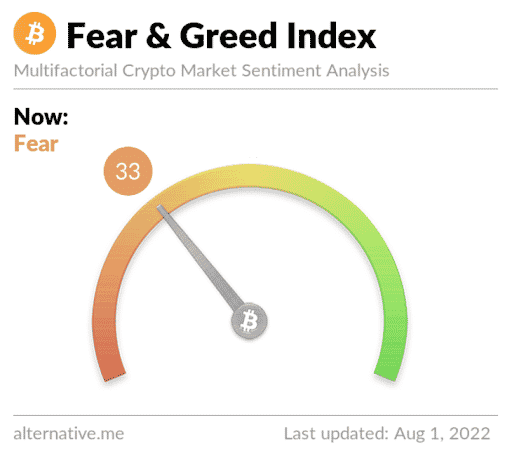

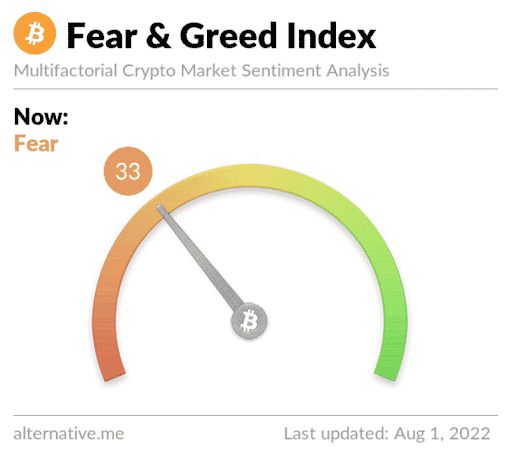

The Fear and Greed Index is 33 Fear and is -6 from Sunday’s reading of 39 Fear.

Bitcoin’s Moving Averages: 5-Day [$22,786.22], 20-Day [$21,646.27], 50-Day [$23,907.57], 100-Day [$31,549.46], 200-Day [$39,905.07], Year to Date [$34,648.08].

BTC’s 24 hour price range is $23,233-$24,211 and its 7 day price range is $20,783-$24,581. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $39,922.

The average price of BTC for the last 30 days is $21,540.2 and its +18.9% over the same time frame.

Bitcoin’s price [-1.46%] closed its daily candle worth $23,294 and in red figures for the third consecutive day on Sunday.

Ethereum Analysis

Ether’s price also traded lower on Sunday and concluded its daily session -$15.72.

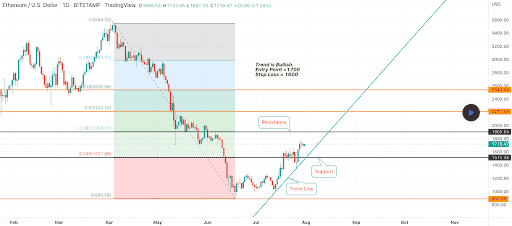

The second chart for analysis this Monday is the ETH/USD 1D chart below by dawoodaslam. ETH’s price is trading between 0.236 [$1,521.86] and 0.382 [$1,909.31], at the time of writing.

If bullish Ether traders can break through the $1,800 on the 4HR chart their next target is on the daily timescale and is the 0.382% fib level. Bullish Ether traders have a secondary target of 0.5 [$2,222.45] followed by 0.618 [$2,535.58] as a third target.

At variance with bulls are bearish Ether traders that want to retest 0.236 with a secondary target of 0 [$895.59].

Ether’s Moving Averages: 5-Day [$1,599.22], 20-Day [$1,364.50], 50-Day [$1,440.74], 100-Day [$2,138.85], 200-Day [$2,858.29], Year to Date [$2,397.33].

ETH’s 24 hour price range is $1,666-$1,754.69 and its 7 day price range is $1,367-$1,759. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $2,554.78.

The average price of ETH for the last 30 days is $1,359.9 and its +59.32% over the same duration.

Ether’s price [-0.93%] closed its daily candle on Sunday worth $1,680.07 and in red digits for the third day in a row.

Chainlink Analysis

Chainlink’s price also wasn’t exempt from the macro applying downside pressure to the aggregate market on Sunday and LINK finished its daily trading session -$0.16.

The third chart today is the LINK/USD 1M Perpetual Futures chart below from ANTONHUSKY. Over the last few weeks bullish traders have been able to regain the 0.309 fibonacci level and 0.382 [$6.65]. LINK’s price is trading between 0.382 and 0.5 [$9.28], at the time of writing.

Bullish LINK traders are eyeing the 0.5 fib level followed by 0.618 [$12.95], and 0.702 [$16.42].

From the bearish perspective, they’re aiming to push LINK’s price back below 0.382 with a second target of 0.309 [$5.41]. The third target to the downside for bears is 0.236 [$4.40].

Chainlink’s Moving Averages: 5-Day [$6.99], 20-Day [$6.64], 50-Day [$6.88], 100-Day [$9.90], 200-Day [$15.89], Year to Date [$12.59].

LINK’s price is +10.84% against The U.S. Dollar for the last 7 days, +6.72% against BTC, and +5.21% against ETH, over the same duration.

Chainlink’s 24 hour price range is $7.58-$8.09 and its 7 day price range is $6.14-$8.17. LINK’s 52 week price range is $5.32-$38.17.

Chainlink’s price on this date last year was $22.11.

The average price of LINK over the last 30 days is $6.65 and its +23.96% over the same timespan.

Chainlink’s price [-1.94%] closed its daily session worth $7.66 on Sunday and in red figures for a second consecutive day.