On 15 September, the ethereum blockchain is planning to switch off its mining rigs. If it happens, it should reduce the carbon emissions of the entire ethereum ecosystem by orders of magnitude overnight, leaving bitcoin as the only major cryptocurrency to be built on the destructive proof-of-work concept. But the switchover could also throw some of the largest institutions in the sector into chaos, and seems likely to evolve into a cold war between the new version of ethereum and the diehard followers of the old. And that’s if it happens at all.

A brief refresher on cryptocurrencies. The two biggest in the world, ethereum and bitcoin, are based on an idea called proof of work. This – and I’m simplifying – involves the networks outsourcing their security to a decentralised network of miners, who compete to burn ludicrous amounts of electrical energy to generate lottery tickets. Each time a winning lottery ticket is generated, the miner who did so gets a reward (for bitcoin, that is currently 6.25BTC – about £110,000), and gets to verify all the transactions that have happened since the last winner, packaging them up into a neat block, and adding them on to the chain made up of all previous blocks. They stamp the block with their lottery number and the process begins again.

Nearly all of the above paragraph is false, so please do not write to me. It is true enough for what follows: this proof-of-work model is at the root of everything you’ve heard about the environmental impact of cryptocurrencies. And ethereum is planning to drop it.

The replacement is called proof of stake. Conceptually, it is more complex, but with the same broad brushstrokes we can describe it like this: rather than burning electricity to generate lottery tickets, you instead use your ethereum to buy premium bonds, and the system picks a winner in proportion to the amount of bonds they’ve bought, who then gets to do all the validation stuff as normal. You can cash out of your premium bonds, but the process is slow, so you are motivated not to abuse your validation privileges.

A version of ethereum has been running on those principles for a while. It’s had different names over the years, from testnet to Eth2, but on 15 September it’s going to become simply ethereum. This switchover, dubbed “the merge” – because the old and the new networks will be merged together – has a good shot at being the single largest technological event ever to happen in the crypto space. Which means it has a good shot at being messy as hell.

To start, there’s the date. If you’ve noticed a soupçon of scepticism, it’s because I’ve been burned before. I wrote about the forthcoming merge being “months away” – in May 2021:

The switch to proof of stake has been planned for several years, with a host of problems, both technical and organisational, delaying implementation. But now, according to Carl Beekhuizen, a research and development staffer at the Ethereum Foundation … the change will be complete “in the upcoming months”.

It was not.

But this time, the switch is rather more final. For one thing, there’s an actual hard date; for another, the preparation for the merge is now live in the code that runs the ethereum network. It could still be delayed, but the default case, if no further action is taken, is that the merge will happen as planned.

What’s at stake

That doesn’t mean the merge will be smooth. The first stumbling block will be the forks: clones of the old version of ethereum, spun up to keep the proof of work system alive.

This won’t be the first time this has happened. There’s untold bitcoin forks, with names like bitcoin cash, bitcoin satoshi vision, bitcoin classic and bitcoin gold, but none have ever toppled the original’s dominance.

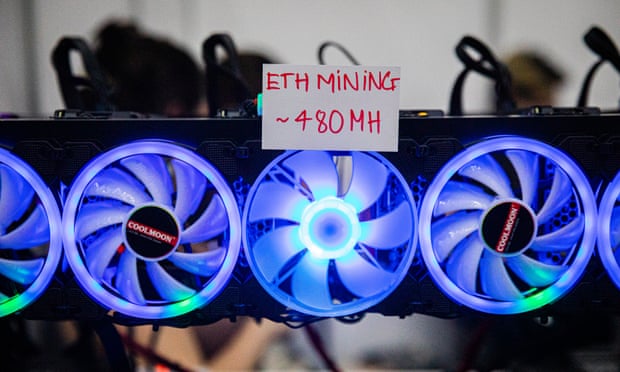

So why might the ethereum fork have more of a chance? Because it will almost certainly have the backing of a powerful constituency: ethereum miners. After years at the centre of ethereum infrastructure, the miners face their industry being simply switched off overnight, and many of them aren’t happy with that proposal. They have real, physical assets invested in the continuation of a proof-of-work cryptocurrency, from expensive graphics cards to electrical hookups, and it’s not easy to repurpose it for something else.

Due to the open-source nature of cryptocurrencies, it’s easy enough for the miners to simply pick up where they left off, and carry on running Nu-thereum, or whatever it gets called, on 16 September as though the merge had never happened. The question is, what happens next?

Everyone who has a balance of ETH will suddenly find that they have two balances, one on each blockchain. And everyone who has a smart contract running on ETH will suddenly find they have two of them, as well: there will be the proof-of-work version of the Bored Ape NFTs, and the proof-of-stake version, and so on.

Some of those duplicates may happily coexist. Others might try to talk down the forked version, but never quite kill it – how much would someone who wants to own a killer NFT pay for an “unofficial” version on the forked chain? If it’s not zero, then the trade could continue for some time, even if the developers of the Apes disown the forks.

But for other projects, there can only be one. Each USDC token is backed by $1 of hard assets held by Circle, the company that develops the stablecoin. If there are suddenly twice as many USDCs because of the fork, Circle doesn’t have twice as much cash, and it will have to choose one network to support and the other to reject.

It seems unlikely that the big stablecoins, like USDC and Tether, will back the rebel chain. And that, in turn, means the entire rebel ecosystem will come into existence in a slow-motion collapse, as forked projects fail one by one. But it will still provide a base for new creation, and one that is ultimately more similar to the ethereum developers know and love than the environmentally friendly version it is about to morph into.

What’s next

The upstart miners aren’t solely acting out of self-interest. There is a point of principle at stake, as well, which is the decentralisation that underpins the crypto economy. That decentralisation is, at heart, the only real reason for cryptocurrencies to exist: a centralised conventional database is faster, cheaper and safer to run, but requires you to trust whoever is running it.

A decentralised cryptocurrency can’t be interfered with by big business, or big government, which makes them great for – well, crime and evasion of government regulations, in the main, but also loftier concepts like “permissionless innovation” and “uncensorable speech”.

Some of the backers of the proof-of-work (PoW) concept – including the bitcoin “maximalists” who look down even on upstarts like ethereum – worry that proof of stake (PoS) ultimately results in Dino: decentralisation in name only. The nature of the system involves handing control of the network to those with the most money held within the network. Worse, it hands extra power to those who look after other people’s money: centralised exchanges like Coinbase or Binance, and centralised notbanks like Celsius or Voyager, if they’d survived that long. Those exchanges can offer “staking” services where they do the hard technical bit of making proof of stake work (buying the premium bonds, in the terms of my fantastic analogy), and their customers get the rewards.

The rise of the Dinos is more than just a theoretical concern. In a post-Tornado Cash world – still dealing with the fallout of North Korea’s favourite decentralised app being accused of money laundering and sanctioned by the US Office of Foreign Assets Control (OFAC) – it isn’t at all clear whether it is legal under US law for a “validator”, the PoS replacement for miners, to approve a block that contains a transaction to or from a sanctioned address.

Ethereum’s developers are trying to force the matter, proposing a “credible commitment to punish censors”. What that means is not yet clear, but the hope is that it doesn’t have to be – that the credible commitment means that organisations who have to comply with OFAC simply do not stake ethereum in the first place.

It is not entirely clear what an ethereum with no validators who are trying to remain in compliance with US sanctions would look like. But that is the world we’re heading to.

If you want to read the complete version of the newsletter please subscribe to receive TechScape in your inbox every Wednesday.