It’s been a wild handful of days for Bitcoin, but despite the volatility it’s currently about where it was this time last week. Meanwhile, XRP is trading up again on fresh SEC court case news and Chainlink has made a raft of announcements.

Let’s start with Ripple, its token XRP, and the Securities and Exchange Commission.

‘Cuckoo for cocoa puffs’: Ripple CEO

Last week, after both Ripple Labs and the SEC filed summary judgments in an attempt to get their bitter court dispute resolved, Ripple CEO Brad Garlinghouse stated on Fox Business that the SEC had “lost its way” and was “cuckoo for cocoa puffs”.

“As the summary judgment filings were made public people realised that maybe the SEC really is overreaching,” said Garlinghouse. “They really aren’t following a faithful allegiance to the law – that’s a quote from the judge in this case.” He further added: “We think [the judge] has the necessary information to make the ruling and we think it’s very clear that the SEC is grossly overreaching its authority.”

The XRP token surged more than 50% in response, hanging above US$0.50 for the first time in about four months. Over the past week, XRP had since lost a fair amount of those gains, however, it’s now spiking again and potentially making another dash for the 50 cent mark.

In a fresh update to proceedings on September 29, Ripple Labs scored a small win with US District Court judge Analisa Torres ruling to release documents written by former SEC corporation finance division director William Hinman.

The documents relate to a speech Hinman delivered at the Yahoo Finance All Markets Summit in June 2018 and are considered important by Ripple for their precedent-setting tone, in which Hinman reportedly stated that Ethereum was not a security.

Ripple Labs views this as meaningful evidence in its defence against the SEC’s allegations that its 2018 sales of XRP violated US securities laws. The judge’s decision overruled SEC objections to the release of the documents.

Judge Torres agreed with Judge Netburn on EVERY single issue related to the HINMAN EMAILS.

Relevance: Check

Attorney-Client Privilege: Check

DPP: CheckSome days I’m proud of this profession. 🙂#TurnOverTheEmails https://t.co/KoGrgm953S

— Jeremy Hogan (@attorneyjeremy1) September 29, 2022

The @SECGov continues to deliberately foster uncertainty rather than provide clear guidance, which is why we are vigorously defending this case on behalf of the entire crypto industry.”

— Eleanor Terrett (@EleanorTerrett) September 29, 2022

A final ruling on the ongoing legal stoush is expected by mid December, although may arrive sooner if the summary judgments have significant bearing on the decision.

Onto some daily price action and other happenings.

Top 10 overview

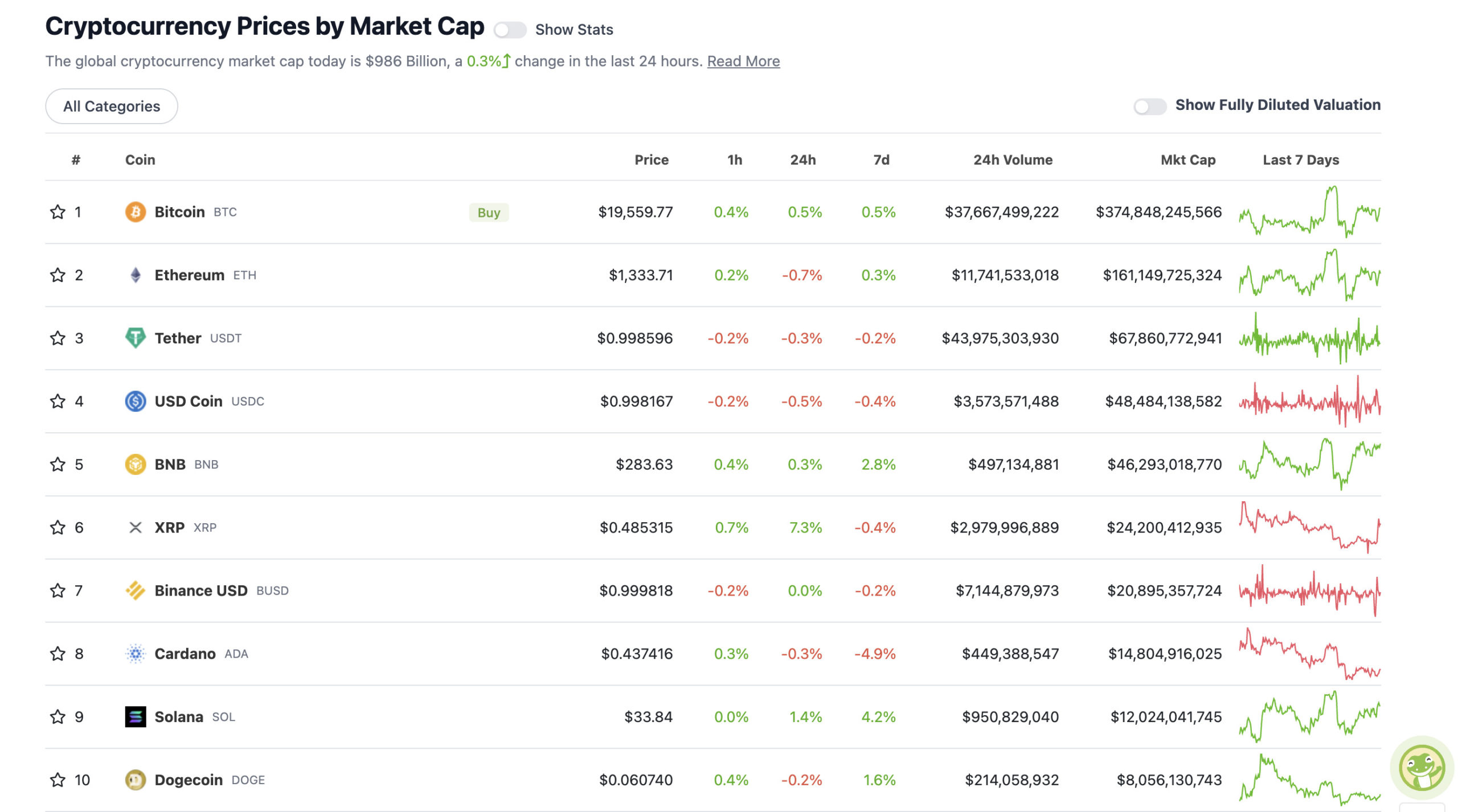

With the overall crypto market cap at US$986 billion and up about 0.3% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As you can see, most of the crypto market is trading pretty flat over the past 24 hours, aside from XRP, which is posting a +7% gain at the time of writing. (High-speed layer 1 blockchain Solana, however, is the clear weekly winner for mild gainage.)

As for the crypto market’s version of the pace-setting rabbit at a dog track (that’d be Bitcoin), how’s it shaping up? It’s not looking TOO bad at the US$19,500 level – still trading within about a $1,000 range as it has been for a couple of weeks now.

A closer look at how the US dollar’s tracking and where it might be heading – at least in the short term – could give us a clue to a potential move for BTC in October. (But note the words: ‘might’, ‘could’ and ‘potential’.)

Here’s another Twitter-based take from the popular US crypto analyst Justin Bennett…

24 hours until this $DXY weekly candle closes.

I’m still macro bullish on the USD, but I see no reason to be bullish on it in October, given how the charts are setting up. pic.twitter.com/KQvUVbwEm6

— Justin Bennett (@JustinBennettFX) September 29, 2022

Uppers and downers: 11–100: Chainlink’s SWIFT news and more

Sweeping a market-cap range of about US$7.42 billion to about US$388 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• XDC Network (XDC), (market cap: US$427 million) +6%

• Stellar (XLM), (mc: US$2.93 billion) +5%

• EOS (EOS), (mc: US$1.21 billion) +4%

• NEO (NEO), (mc: US$618 million) +3%

• Chainlink (LINK), (mc: US$3.88 billion) +1%

Chainlink (LINK) is not leading the daily gainers, however it is up 10% over the past seven days, so it’s one of the best performers around using that metric.

The crypto industry’s premier oracle network has a raft of large news, which it’s been announcing at its SmartCon 2022 event in New York this week.

(An oracle in the crypto world, by the way, is a decentralised network that provides real-world data to smart contracts on the blockchain.)

Firstly, the project has revealed it’s building a token infrastructure for SWIFT – the global standard for cross-border international payments. Huge.

SWIFT is set to use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) in an “initial proof of concept”.

Why is this a big deal? The collaboration will enable financial institutions to become blockchain capable without the need for massive upfront integration costs and development time.

SWIFT is using the Cross-Chain Interoperability Protocol (CCIP) in an initial proof of concept.

CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the SWIFT network become interoperable across all blockchain environments.https://t.co/8GOBNhzwCk pic.twitter.com/Pvm0Cex45e

— Chainlink (@chainlink) September 28, 2022

The SmartCon conference also saw Chainlink co-founder Sergey Nazarov unveil the launch of SCALE; a new economic-sustainability model for the highly regarded and widely partnered Web3 infrastructure platform.

And last but not least, Nazarov also revealed that plans for the launch of Chainlink’s long-awaited staking rewards functionality are set to go ahead in December.

DAILY SLUMPERS

• Evmos (EVMOS), (market cap: US$479 million) -12%

• STEPN (GMT), (mc: US$388 million) -4%

• Kava (KAVA), (mc: US$433 million) -3%

• Uniswap (UNI), (mc: US$4.79 billion) -3%

• Helium (HNT), (mc: US$647 million) -3%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

📰Big News#SWIFT has partnered with #Chainlink $LINK to work on a proof-of-concept project which would allow TradFi firms the ability to transact across blockchain networks

SWIFT has also been exploring CBDCs to facilitate faster payments$LINK is the future of global finance

— Kevin Svenson (@KevinSvenson_) September 29, 2022

zkSync has a confirmed token, and mainnet is launching early October.

Might be a good idea to try a few protocols.

Today’s birds: @zksync, @Orbiter_Finance, @1kxprotocol, @primex_official, @PhezzanProtocol, @MESprotocol

Strategy: bridging + testnets from emerging protocols 👇

— olimpio.lens ⚡️ (@OlimpioCrypto) September 29, 2022

KAMALA HARRIS: “The United States shares a very important relationship, which is an alliance with the Republic of North Korea.” pic.twitter.com/H2dI5UYOlo

— RNC Research (@RNCResearch) September 29, 2022

GAME ON 🚀 → @StarAtlas teams up with @EpicGames Store as their launch partner for their highly anticipated, AAA Space Exploration Game!

Epic Games Store is doubling-down on Web3 gaming and continues to work with innovative gaming studios!

Big W for Star Atlas + @solana! 🥳 pic.twitter.com/gtjvjBPYxq

— Brycent 🚀 (@brycent_) September 29, 2022

Hello everyone, Janice here.

Someone has taken the claim of John still being alive to be true & sent people to follow me. I’ve been being followed off & on since John died but this was more than usual. Almost made me uneasy, then I remembered my training.

John taught me well.

— John McAfee (@officialmcafee) September 29, 2022