{“menuItems”:[{“label”:”What is Zilliqa?”,”anchorName”:”https://www.finder.com.au/#learn”},{“label”:”Where to buy Zilliqa”,”anchorName”:”https://www.finder.com.au/#buy”},{“label”:”How it works: The technology behind Zilliqa”,”anchorName”:”https://www.finder.com.au/#behind”},{“label”:”Achieving consensus: When PoW met BFT”,”anchorName”:”https://www.finder.com.au/#achieving”},{“label”:”What is ZIL?”,”anchorName”:”https://www.finder.com.au/#what”},{“label”:”The Zilliqa team”,”anchorName”:”https://www.finder.com.au/#team”},{“label”:”Notable partnerships”,”anchorName”:”https://www.finder.com.au/#notable”},{“label”:”Wallets that support ZIL”,”anchorName”:”https://www.finder.com.au/#support”},{“label”:”Whatu2019s next for Zilliqa: The Zilliqa roadmap”,”anchorName”:”https://www.finder.com.au/#roadmap”},{“label”:”What to watch out for”,”anchorName”:”https://www.finder.com.au/#watch”},{“label”:”Bottom line”,”anchorName”:”https://www.finder.com.au/#bottom”}]}

Scalability is one of the biggest challenges facing existing blockchain platforms. As bitcoin, Ethereum and a host of other big players continue to brainstorm and test scaling solutions, there are several new projects at varying stages of development designed to offer a much higher transaction throughput.

Zilliqa is one of those platforms. Billing itself as a “next-gen high throughput blockchain platform”, Zilliqa uses sharding in an effort to scale up to thousands of transactions per second.

So, how does it all work and does Zilliqa have what it takes to deliver the goods? Let’s take a closer look.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific

provider, service or offering. It is not a recommendation to trade.

What is Zilliqa?

Zilliqa is a public blockchain platform designed to process thousands of transactions per second. One of the biggest problems facing many blockchain platforms is a lack of scalability – essentially, the larger a network gets, the harder it is to reach consensus, and the average per-second transaction rates of many cryptocurrencies leave a lot to be desired.

Through the use of sharding – dividing the network into several smaller component networks that can process transactions in parallel – Zilliqa’s transaction rate actually increases as the mining network expands. Theoretically, Zilliqa will be able to match and possibly even exceed Visa, the largest payment processor in the world.

The platform is also be designed to support smart contracts and dapps, allowing users to build and deploy decentralised exchanges, financial algorithms, high-performance scientific computing applications and more.

Where to buy Zilliqa

How it works: The technology behind Zilliqa

Other popular solutions under consideration to solve the blockchain scalability problem include moving some information off-chain, or increasing the block size. While they certainly offer improvements, they fall well short of offering the transaction throughput needed by the increasing number of applications built on smart contract platforms.

Zilliqa’s solution is to implement sharding, which basically takes a “divide and conquer” approach to scaling. There are multiple forms of sharding in Zilliqa – network sharding, transaction sharding and computational sharding – but network sharding is the most critical.

Network sharding involves dividing the Zilliqa network into separate groups of nodes, which are called shards. In practice, for security reasons, Zilliqa requires every shard to have at least 600 nodes.

However, for the sake of a simple explanation, let’s assume that if the network has 1,000 nodes, it can be divided into 10 shards that each consist of 100 nodes. Each shard can process transactions in parallel, so if one shard can process 20 transactions per second (hypothetically), then the powers of all shards combined can process 200 transactions per second.

And because these shards can process transactions in parallel, the more nodes that join the network, the more transaction throughput Zilliqa can handle.

Achieving consensus: When PoW met BFT

Zilliqa’s network uses a hybrid consensus mechanism. Proof-of-work (PoW) is used to establish mining identities, to perform network sharding and to offer protection against so-called Sybil attacks (when malicious nodes create multiple identities and try to influence the decision-making process).

However, PoW is not used for consensus, and Zilliqa instead relies on a practical Byzantine Fault Tolerant (pBFT) protocol. Used within each shard, this mechanism offers higher throughput and also guarantees finality, with the last step of the protocol requiring nodes to sign that they have all seen and agreed on the block.

With the ability to process 8,000 transactions per second, Visa is the largest payment processor in the world. During testnet trials in April 2018, Zilliqa achieved speeds of up to 2,000 transactions per second.

At time of writing (November 2019) Zilliqa says it has achieved 2,828 transactions per second on its live network. As Zilliqa’s capacity is designed to increase in line with the size of the network, there is further room to grow.

By way of comparison, Ethereum currently handles roughly 15 transactions per second.

What is ZIL?

ZIL is the ticker symbol of Zilliqa’s native currency token, Zillings. ZIL tokens are used for mining rewards, transaction fees and smart contract execution.

A total of 21 billion ZIL were created, with 6.3 billion distributed during the platform’s January 2018 token generation event. A further 6.3 billion tokens were distributed to investors, Zilliqa Research, the founding team and other supporting organisations, with the remaining 8.4 billion ZIL to be released as mining rewards.

The Zilliqa team

Zilliqa can trace its roots back to 2015, when some of its team members proposed the theory of sharding in an academic paper. The protocol has since been researched and developed through Anquan Capital Pte Ltd, a Singapore-based technology company.

The Zilliqa team is led by CEO Amrit Kumar. Most team members have a PhD in computer science or engineering, and the project’s list of advisors includes Kyber Network co-founder Loi Luu, founding partner of FBG Capital Vincent Zhou, and many more.

Zilliqa’s January 2018 token sale raised US$22 million in funding.

Notable partnerships

Zilliqa has secured several important partners, including:

- Insurance Market. Zilliqa joined forces with online insurance broker Insurance Market, Deloitte and regional insurance group FWD to launch Inmediate, a collaborative ecosystem for blockchain-based insurance.

- Noorcoin. The world’s first sharia-compliant utility token partnered with Zilliqa in April 2018 to test Zilliqa’s blockchain protocol for on-chain high-throughput transactions.

- Mindshare. Announced in November 2017, this partnership with the global media agency tested whether Zilliqa’s blockchain protocol can be used to address a number of challenges facing the digital advertising industry. Following successful results, this trial resulted in the launch of the Aqilliz advertising blockchain platform.

- Infoteria. In August 2018, Zilliqa partnered with Infoteria, which is an industry leading enterprise software company in Japan. The Zilliqa team plan to use the partnership to push Zilliqa into the market via Infoteria’s ASTERIA middleware product. ASTERIA already has 6.500 users, and will allow clients to take advantage of Zilliqa’s dapps and high-throughput blockchain.

- Xfers. In June 2019, Zilliqa inked a partnership with Xfers, a Singapore-based fintech startup that services a total of over 10 million unique active users every month across Singapore and Indonesia, with the goal of developing blockchain payment applications.

Wallets that support ZIL

Rather than storing your tokens on an exchange, which exposes you to the risk of hacking and theft, most users recommend moving your crypto holdings into a private wallet.

ZIL tokens are supported by a wide range of popular cryptocurrency wallets. Compare cryptocurrency wallets to find the one that’s right for you.

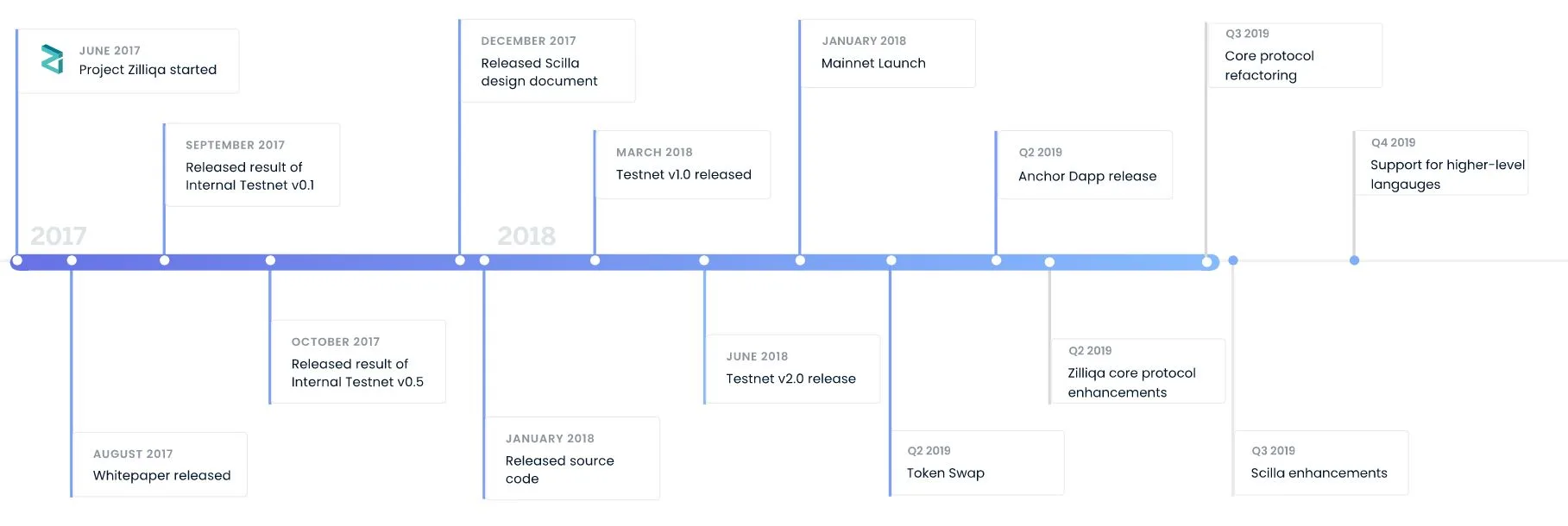

What’s next for Zilliqa: The Zilliqa roadmap

2019 was a big year for Zilliqa, with the successful launch of the mainnet in Q1 of 2019.

Going forwards, the Zilliqa roadmap includes enhancements to the platform’s native Scilla programming language, further evolutions of its core protocol and the addition of support for higher-level programming languages.

What to watch out for

The launch of the Zilliqa mainnet demonstrated that the technology behind the network can perform in real world conditions. But there’s still the not insignificant matter of the competition.

Ethereum has its own sharding plans and is also working on a number of other improvements to solve scalability bottlenecks, plus it has the advantage of being an established player. Other smart contract platforms like NEO, which claims to be able to process up to 1,000 transactions per second, could also limit Zilliqa’s adoption. There’s no shortage of other platforms with their own scaling solutions.

https://www.youtube.com/watch?v=_Iojus_cRxM?feature=oembed&enablejsapi=1

Bottom line

Zilliqa has proven itself to be a functional, high-scalability blockchain platform in real world conditions, but many of the speculators hoping that these successes would translate into large ZIL price gains have so far been disappointed.

With this in mind, make sure you do your own research before deciding whether or not you should buy any ZIL. The project’s whitepaper, position paper and mega FAQ are all excellent resources to help you understand the technology behind Zilliqa and the features it offers. But bear in mind that the cryptocurrency markets are highly unpredictable, and don’t always perform the way you’d expect.

Latest Zilliqa news

Zilliqa-powered stablecoin launched by Xfers

{“menuItems”:[{“label”:”What is Zilliqa?”,”anchorName”:”https://www.finder.com.au/#learn”},{“label”:”Where to buy Zilliqa”,”anchorName”:”https://www.finder.com.au/#buy”},{“label”:”How it works: The technology behind Zilliqa”,”anchorName”:”https://www.finder.com.au/#behind”},{“label”:”Achieving consensus: When PoW met BFT”,”anchorName”:”https://www.finder.com.au/#achieving”},{“label”:”What is ZIL?”,”anchorName”:”https://www.finder.com.au/#what”},{“label”:”The Zilliqa team”,”anchorName”:”https://www.finder.com.au/#team”},{“label”:”Notable partnerships”,”anchorName”:”https://www.finder.com.au/#notable”},{“label”:”Wallets that support ZIL”,”anchorName”:”https://www.finder.com.au/#support”},{“label”:”Whatu2019s next for Zilliqa: The Zilliqa roadmap”,”anchorName”:”https://www.finder.com.au/#roadmap”},{“label”:”What to watch out for”,”anchorName”:”https://www.finder.com.au/#watch”},{“label”:”Bottom line”,”anchorName”:”https://www.finder.com.au/#bottom”}]}

The economic landscape of Southeast Asia makes DeFi a necessity, and stablecoins help.

Aqilliz: Zilliqa poised to become global advertising blockchain

{“menuItems”:[{“label”:”What is Zilliqa?”,”anchorName”:”https://www.finder.com.au/#learn”},{“label”:”Where to buy Zilliqa”,”anchorName”:”https://www.finder.com.au/#buy”},{“label”:”How it works: The technology behind Zilliqa”,”anchorName”:”https://www.finder.com.au/#behind”},{“label”:”Achieving consensus: When PoW met BFT”,”anchorName”:”https://www.finder.com.au/#achieving”},{“label”:”What is ZIL?”,”anchorName”:”https://www.finder.com.au/#what”},{“label”:”The Zilliqa team”,”anchorName”:”https://www.finder.com.au/#team”},{“label”:”Notable partnerships”,”anchorName”:”https://www.finder.com.au/#notable”},{“label”:”Wallets that support ZIL”,”anchorName”:”https://www.finder.com.au/#support”},{“label”:”Whatu2019s next for Zilliqa: The Zilliqa roadmap”,”anchorName”:”https://www.finder.com.au/#roadmap”},{“label”:”What to watch out for”,”anchorName”:”https://www.finder.com.au/#watch”},{“label”:”Bottom line”,”anchorName”:”https://www.finder.com.au/#bottom”}]}

Aqilliz aims to help companies replicate the success of the Mindshare-PepsiCo trial with Zilliqa.

Zilliqa and Xfers partner to explore blockchain payments

{“menuItems”:[{“label”:”What is Zilliqa?”,”anchorName”:”https://www.finder.com.au/#learn”},{“label”:”Where to buy Zilliqa”,”anchorName”:”https://www.finder.com.au/#buy”},{“label”:”How it works: The technology behind Zilliqa”,”anchorName”:”https://www.finder.com.au/#behind”},{“label”:”Achieving consensus: When PoW met BFT”,”anchorName”:”https://www.finder.com.au/#achieving”},{“label”:”What is ZIL?”,”anchorName”:”https://www.finder.com.au/#what”},{“label”:”The Zilliqa team”,”anchorName”:”https://www.finder.com.au/#team”},{“label”:”Notable partnerships”,”anchorName”:”https://www.finder.com.au/#notable”},{“label”:”Wallets that support ZIL”,”anchorName”:”https://www.finder.com.au/#support”},{“label”:”Whatu2019s next for Zilliqa: The Zilliqa roadmap”,”anchorName”:”https://www.finder.com.au/#roadmap”},{“label”:”What to watch out for”,”anchorName”:”https://www.finder.com.au/#watch”},{“label”:”Bottom line”,”anchorName”:”https://www.finder.com.au/#bottom”}]}

Decentralised and centralised fintech is coming together to shake up the payments landscape.

Images: Shutterstock

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly

volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of

future performance. Consider your own circumstances, and obtain your own advice, before relying on this information.

You should also verify the nature of any product or service (including its legal status and relevant regulatory

requirements) and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.