35mmf2/iStock via Getty Images

Thesis Summary

Last weekend Bitcoin (BTC-USD) broke past a key resistance level, and bullishness returned to the market. However, many altcoins, Ethereum (ETH-USD) included, had already shown a lot of promising signs of reversal.

In this article, I discuss why I believe “altseason”, a period where altcoins outperform Bitcoin, has begun, and recommend 3 Altcoins you should own.

Altseason has begun

Since crypto markets began to gain popularity, investors and traders have been looking at optimum strategies to maximize returns. One such strategy relates to understanding the different market cycles, and one of them is altseason. While generally crypto moves together, there are some periods where Bitcoin leads the pack, but also others where altcoins outperform Bitcoin. There are a few charts that can give us some insight into this dynamic, and help us determine if altseason is upon us.

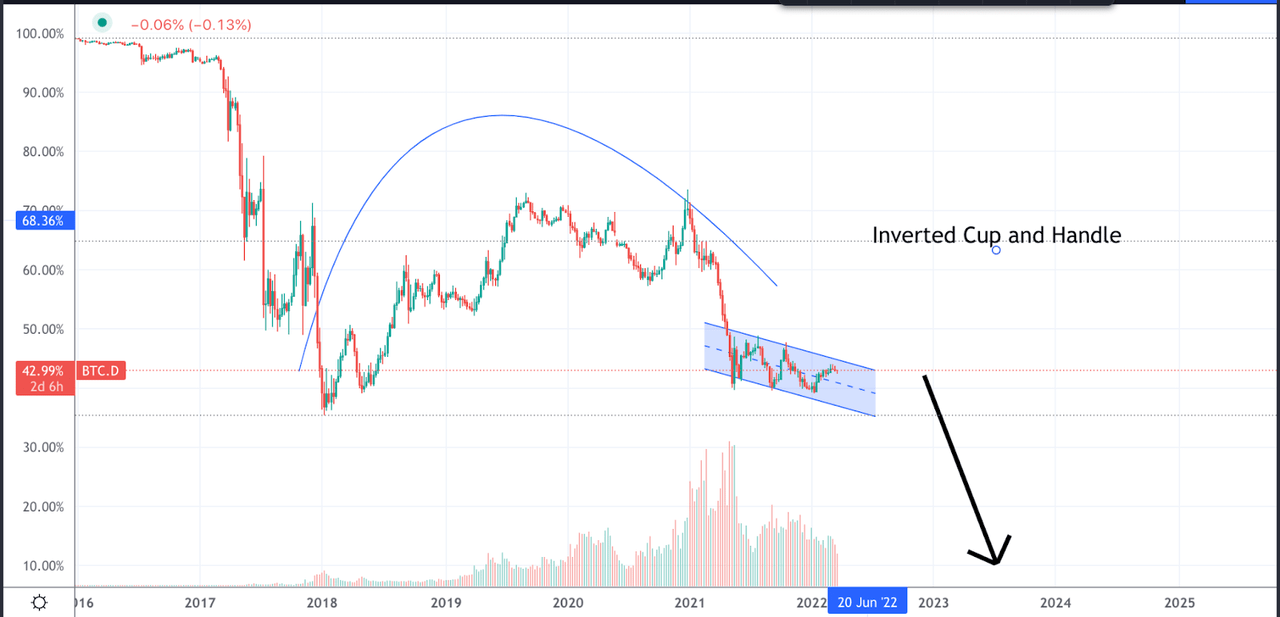

BTC Dominance (Author’s work)

The chart above shows the percentage of the total crypto market cap that is made up of Bitcoin. This has been in a clear downtrend since 2016, which is understandable given that more altcoins are appearing every week. However, we see that altcoin dominance peaked in 2018. Bitcoin recovered ground until 2021 when we saw another altseason take place.

What we could identify here is an inverted “cup and handle” pattern, which would suggest that Bitcoin dominance should be heading further down in the future. But this is only one of many indicators we can use.

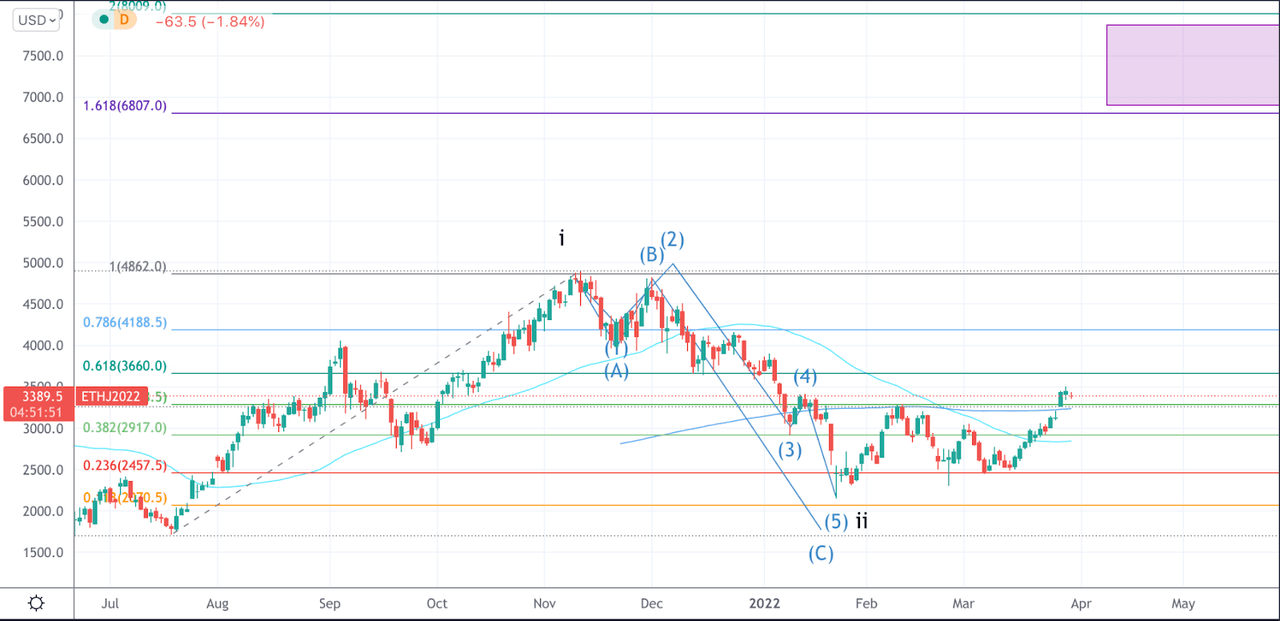

ETH/BTC (Author’s work)

The ETH/BTC chart shows the price of Ethereum in terms of Bitcoin. When the chart goes up, it means Ethereum is outperforming Bitcoin. In the past, big moves in Ethereum have been a warning trigger for the beginning of the altseason.

Lastly, I’d like to talk about a chart that you can see here. It was made by Twitter user @BTCFuel. What we see is an overlay of Altcoins today vs. Bitcoin in 2010-14. The theory is simple. Because altcoins can be thought of as a “newer Bitcoin”, its price today is more correlated to that of Bitcoin in its earlier stages. This means that we should see altcoins price rise more exponentially as Bitcoin did back in the earlier stages of its cycle.

Ethereum, obviously

The first alt you need to own is Ethereum. Ethereum is the most important alt, and it is the leader of the pack. Though Ethereum has had its issues, we have seen some very bullish news come out in recent weeks. The London fork upgrade, combined with the upcoming move to PoS, means that Ethereum will be much more deflationary. The blockchain should be moving to PoS by the end of Q2 or Q3. I talked about this more extensively in my last ETH piece.

This is where I’m expecting Ethereum to go in the next few months.

ETH price (Author’s work)

If we measure the move from 1900 to 4680 as wave i, then the target for wave iii would be around $6800-$8000. This is where the 1.618 and 2 Fibonacci extensions land.

Get some Fantom too

Fantom (FTM-USD) is a layer 2 solution that holds a lot of potential. Even with ETH becoming more scalable, L2 solutions will still be needed, and Fantom has some of the best technology out there. Fantom blockchain can handle around 20,000 tps, and it is designed so that each application in it exists as a separate blockchain within the blockchain.

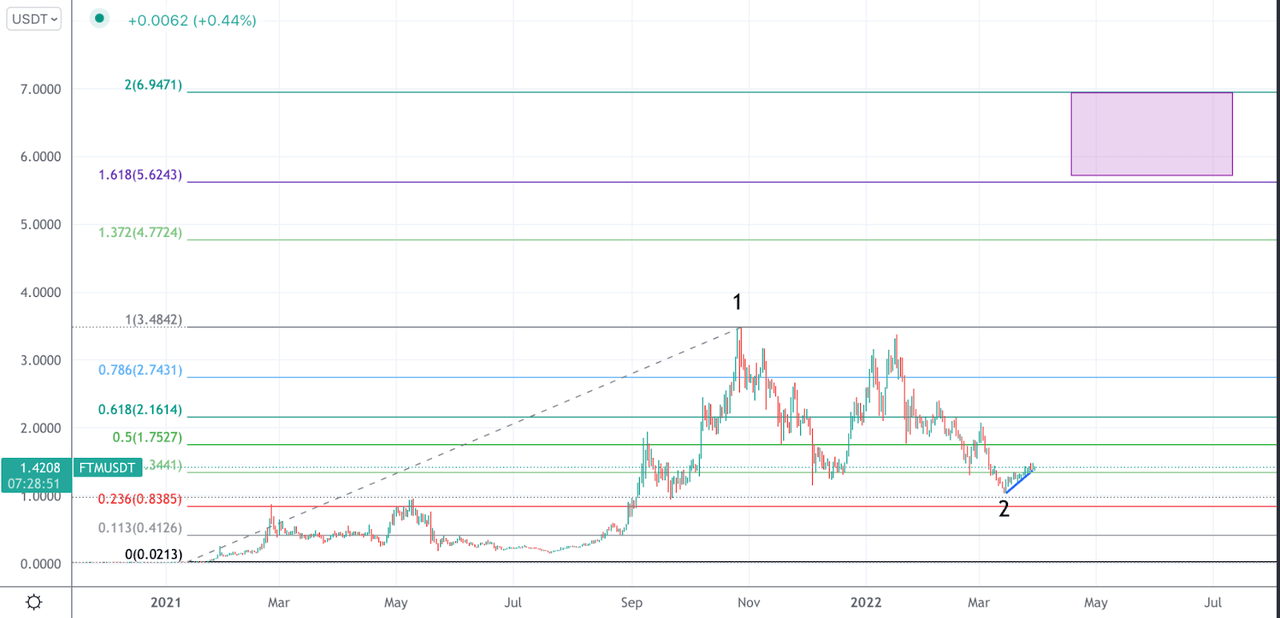

FTM Price (Author’s work)

Using EWT, I believe Fantom could reach a target price of $5.6-$7 in the next move up. That’s 4-5x from today’s price.

And don’t forget Terra’s LUNA

LUNA (LUNA-USD) is the native coin of the Terra blockchain and was created in conjunction with CHAI, the South Korean e-wallet application. The main use of Terra is to support algorithmic stablecoins, like UST, a dollar stablecoin. This is done by providing arbitrage opportunities between said stablecoins and Terra, which ensures that supply and demand balance out at the established peg.

Stablecoins have become incredibly popular, and Terra’s algorithmic coins are solving real-world problems, especially in Korea where the CHAI app is used by merchants to accept payments. To maintain the peg, algorithmic coins require LUNA, which is burned or minted. What is certain though, is that as these stablecoins become more used, demand for LUNA will increase, and so will its price.

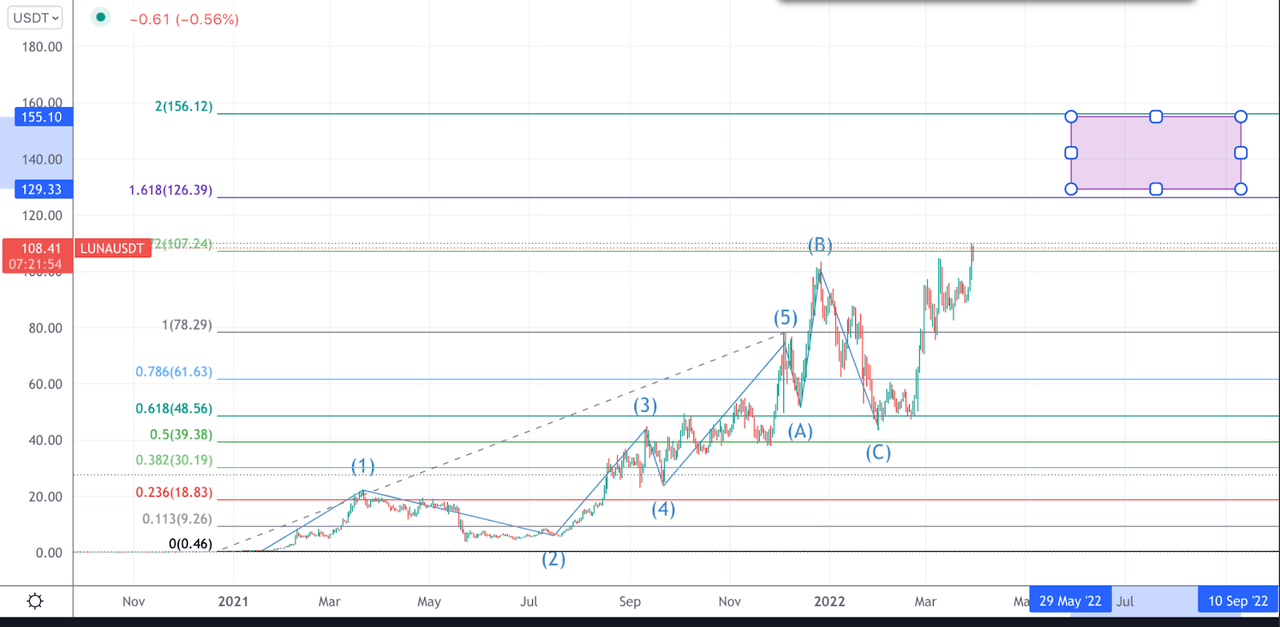

LUNA price (Author’s work)

Looking at LUNA’s chart, we have clear evidence that a bottom is in, and the target for the next wave up should be at least $126-$156. This is not a great return from today’s price, but I still recommend owning LUNA based on its strong fundamentals and use case. Also, we should see some more attractive buying levels in the next few weeks.

Takeaway

I see strong evidence that we have entered another bull phase in crypto, especially for altcoins. Cryptocurrencies have put in convincing bottoms and rallied strongly, but there is still plenty of juice left to squeeze in this rally. We may see more attractive adding levels for a lot of altcoins in the coming weeks, which I would consider the last chance to add before the big rally.