putilich/iStock via Getty Images

Decentralized finance (“DeFi”) lending, one of the fastest-growing sectors in the decentralized ecosystem, could eventually make inroads into the real economy if it becomes less reliant on collateral, the BIS said in a recent report, adding that it also needs to better represent real-world assets on the blockchain via tokenization.

Note that DeFi lending platforms like Celsius and BlockFi allow anonymous users to lend and borrow cryptocurrencies at high interest rates that far exceed what traditional lenders offer to depositors. The problem is that DeFi lending relies heavily on borrowers pledging crypto collateral, limiting “access to credit to borrowers who are already asset-rich,” the BIS said. If high price volatility takes hold in digital coins — as is the case now — “there is overcollateralization: the collateral required tends to be much higher than the loan size.”

Another concern is the lenders offer crypto loans without a central intermediary like a consumer bank, making it near impossible for these crypto lenders to assess borrowers’ creditworthiness and whether they can pay off loans in a timely manner.

Moreover, “anonymity and dependence on collateral are incompatible with DeFi’s aspiration to democratize finance: collateral-based lending only serves those with sufficient assets, excluding those with little wealth,” the BIS pointed out. “The dependence on crypto collateral also prevents real-world use cases,” which is why tokenization “will be essential to overcome DeFi’s self-referential nature and requires both technological improvements and updated legal frameworks.”

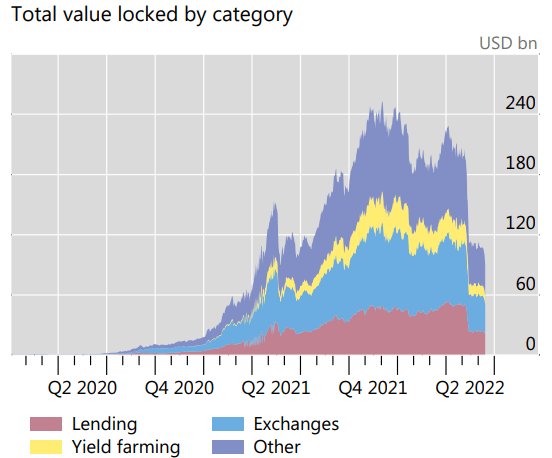

It wasn’t until the end of 2020 when DeFi lending started to emerge. The total value locked in DeFi lending protocols stood at $50B in Q2 2022, up from almost zero at end-2020, but down from an all-time high of around $240B in Q4 2021, as “the recent collapse of Anchor on the Terra blockchain and Celsius’ restrictions on withdrawals have shaken confidence and put a stop to the rapid ascent of crypto lending,” according to the BIS.

Meanwhile, cryptos including bitcoin (BTC-USD) and ethereum (ETH-USD) are cratering from their peaks last year in the worst bear market since the retail-driven bust in 2018, as liquidity shrinks and financial conditions deteriorate. Unsurprisingly, crypto winter impacts DeFi lending in that loans get liquidated amid falling prices, and therefore collateral values decline, as per the report.

Celsius, which promises weekly returns of as much as 30%, has been making the headlines after it paused all customer withdrawals, swaps and transfers in a move that put the rest of the crypto market further on edge. Shortly thereafter, Binance, the world’s largest crypto exchange by trading volume, halted bitcoin (BTC-USD) withdrawals “due to a stuck transaction causing a backlog,” CEO Changpeng Zhao wrote in a Twitter post June 13. More recently, crypto lender Babel Finance has suspended client withdrawals, citing “unusual liquidity pressure.”

Going forward, the ability of DeFi lending to expand its footprint into the real economy depends on whether it can “tokenize real assets and rely less on collateral by developing its ability to gather information about borrowers; as such, the system is likely to gravitate towards greater centralization,” the BIS explained.

Previously, (June 16) Three Arrows Capital failed to meet margin calls after its crypto wagers turned sour.