Although most crypto projects present themselves as problem-solvers for real-world application purposes, few truly succeed. But Theta (THETA) is supposed to be different — in an application that undoubtedly plays a crucial role in the World Wide Web. Namely streaming via providers such as Netflix, YouTube, Twitch, and others.

This is one of the most interesting crypto platforms.

Theta is a new type of decentralized video content delivery network based on blockchain technology.

It is designed to improve the quality of video streaming and reward those who offer their computing resources for improved video delivery.

The Theta Network, which calls itself a “decentralized streaming video protocol,” allows users to offer their spare bandwidth and computing resources in exchange for token rewards.

Founded in 2017 with an ICO that raised approximately $20 million, Theta began operations in 2018. Theta Mainnet was launched in March 2019, with its peer-to-peer decentralized network that allows users to share bandwidth and computing resources.

In December 2020, Theta Labs released the beta version of its decentralized video streaming platform — Edgecast. It is based on Theta’s blockchain technology and is the world’s first video streaming dApp.

The Theta ecosystem does make use of two different tokens: THETA and Theta Fuel (TFUEL). Theta’s native token (THETA) is a governance token that runs on the Theta network. These tokens help to secure the blockchain and are used to provide a variety of functionalities to users.

Theta fuel (TFUEL), on the other hand, are tokens issued to users who watch streams on the network (using their spare bandwidth to share the stream with other viewers).

TFUEL functions similarly to Ethereum Gas and is responsible for interacting with smart contracts on the Theta network. As viewers on the network share content with other viewers, they can earn more tokens. Airdrops also take place regularly, where users receive tokens for performing various tasks.

Like all blockchain networks, Theta is open-source, and token holders have governance powers, as with other proof-of-stake (PoS) systems. Developers can also develop DApps on Theta’s smart contract platform.

The Theta blockchain is the only end-to-end infrastructure for decentralized video streaming and delivery that provides both technical and economic solutions. This is one of the most exciting new blockchain ventures I have heard about. — huffpost.com

Theta’s project originates from Sliver.tv, a company engaged in the development of streaming video technologies based on virtual reality and 360-degree projection.

It is no coincidence that the founders of Theta Network are the same as those of Sliver TV:

- Mitch Liu. CEO and co-founder of Sliver.tv, a leading esports platform committed to pioneering new ways to enjoy such events in an increasingly immersive reality. Liu is also known to be among the founders of Game View Studios, famous for the mobile video game Tap Fish, which has 100 million downloads.

- Jieyi Long. He is the other co-founder of Sliver.tv, now also CTO of Theta, leading the platform’s technical team. He has already developed and obtained numerous patents for virtual reality live streaming and video game technologies.

Noteworthy among the media advisors is the presence of Steve Chen, co-founder of Youtube

Theta’s innovation is set to disrupt today’s online video industry much in the same way that the YouTube platform did to traditional video back in 2005. One of our biggest challenges had been the high costs of delivering video to various parts of the world, and this problem is only getting bigger with HD, 4K and higher quality video streams,” said Steve Chen, Co-Founder of YouTube. “I’m excited to be part of the next evolution of the streaming space, helping Theta create a decentralized peer-to-peer network that can offer improved video delivery at lower costs. — Steve Chen (thetatoken.org)

Which Problem Does It Solve?

Almost all of us use YouTube, Twitch, Netflix, TikTok, Facebook, or other video streaming services. The future of content is on the Internet. The biggest challenge for providers, however, is to deliver all this content to the customer in the best possible quality. The increasing quality of the content, the many new customers, and, above all, the increased demand due to the Corona pandemic cause problems on the part of content providers. According to Cisco, video streaming accounts for about 2/3 of the Internet traffic nowadays. This figure could even climb to 82% in the next few years.

The bottleneck in the transmission of video content is the so-called content delivery network (CDN). The CDN delivers the data directly to the end devices. All consumers are therefore directly connected to the servers of the streaming provider. Especially at peak times, this can be a serious problem. Theta tries to solve this problem with an interesting approach. At the core of this approach are special caching nodes: geographically distributed nodes that are ultimately nothing more than other users of the streaming service.

How Does It Work Technically?

The decentralized nature of Theta establishes a network that the official white paper calls a decentralized streaming network (DSN). In other words, the users themselves become a kind of content delivery network. The Theta Blockchain is based on a Proof of Stake (PoS) and relies on a multi-level byzantine tolerance algorithm — or BFT for short. So-called Guardian Nodes, together with the Validator Nodes- known from other blockchains- and the BFT, ensure a high data throughput of up to 1,000 transactions per second.

Proof of Stake

The consensus algorithm of the Theta Blockchain relies on a proof of stake based approach. This is a trend that many application-oriented blockchains are already relying upon. It allows them to significantly increase their throughput. Moreover, a variety of devices can participate in the consensus algorithm without any special requirements.

Micropayment Pool

At the heart of the Theta network is the resource-based pool for micropayments. This was designed specifically for video streaming and is intended to allow the user to create an off-chain micropayment pool. This pool can be used by the user to pay multiple nodes (cache sharing users) with only one on-chain transaction. It can be compared to a 2nd layer solution like the Lightning network in Bitcoin (Read more: Lightning: The Upgrade That Bitcoin Needs) As the goal is also to relieve the Theta main chain for microtransactions. The validators protect the network from “double spends”.

Part of the economy of Theta are the two tokens THETA and TFUEL, each of which has a very special role. THETA is a classic governance token that can be staked by its holders. Validators also use it to produce new blocks on the Theta Blockchain.

TFUEL is — as the name suggests — something like the fuel in the network. The token is the means of payment to set up and maintain caching nodes, for example. At the same time, users can earn TFUEL by making their computing power available in the decentralized streaming network. In addition, TFUEL tokens can be earned when using the streaming service theta.tv.

In the economy of Theta, there are some roles that the individual network participants can take on.

- Streamers: Streamers are the content producers and deliver content on the streaming platform theta.tv, for instance, which can be viewed by viewers. Also, they could receive TFUEL on their account through donations for example.

- Viewer: This role includes all viewers who consume content on streaming portals or video platforms. They can also earn TFUEL by using theta.tv.

- Advertiser: Similar to what you know from in-video advertising on Twitch or YouTube, advertisers can buy ad space in exchange for THETA tokens.

- Caching Nodes: Users who provide their bandwidth and power to serve content across geographies as Caching Nodes receive TFUEL in return as a reward.

- Guardian Nodes: Guardian Nodes are the stakers in the network. They receive TFUEL as a reward for their work.

THETA, the governance token of the blockchain, is a pre-mined token that was issued as part of the Initial Coin Offering (ICO). These tokens generally have the problem that the groups that receive large portions of the token also have a significant influence on supply and demand.

Theta itself provides transparent information about how the token is distributed. In most ICO projects whose tokens were generated in advance (preminted), this repeatedly leads to problems and, above all, resentment among the “investors”. Many do not understand that the person who controls the supply and can sell at any time also has a significant influence on the price of the token.

- Private Sale: 30%

- Team: 7,49%

- Advisors: 1,23%

- Partners: 12,5%

- Network Seeding: 12,5%

- Labs Reserves: 36.28%

One of the most exciting parts of the Theta ecosystem is certainly the fact that you can earn some TFUEL passively in various ways with Theta. A core component is staking, which is the foundation of the protocol’s Proof of Stake (PoS) algorithm. This means you could build or invest in a Guardian Node and earn TFUEL through THETA Staking. But there are also other ways to earn TFUEL on the network.

Staking

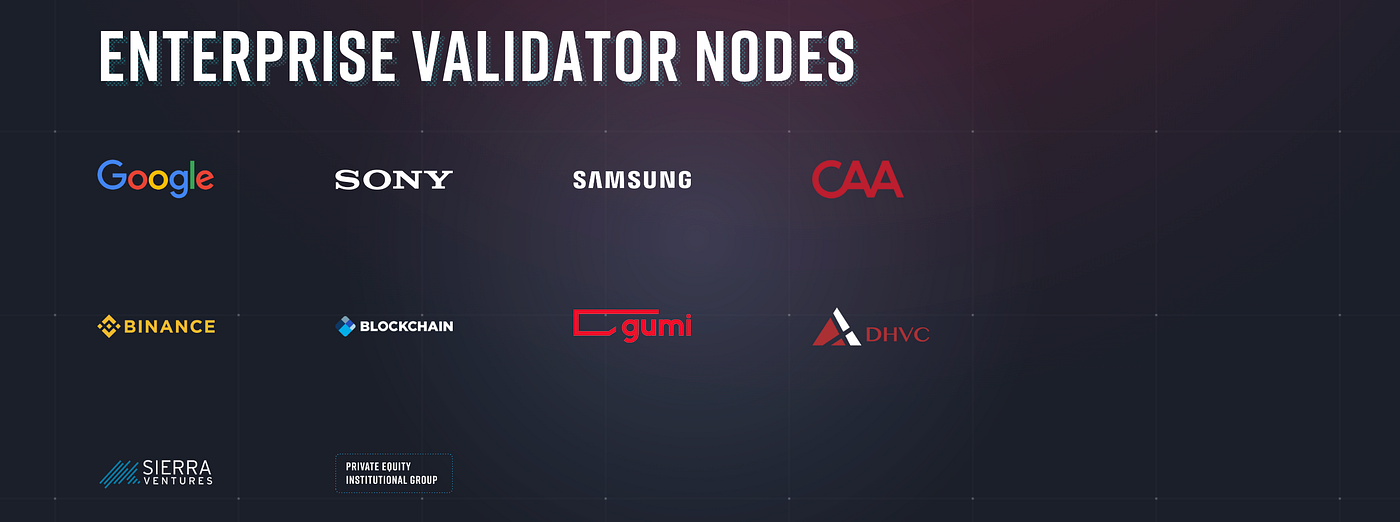

Staking can be done by Validator or Guardian Nodes. However, only selected partners of Theta Labs can become a Validator, and you have to stake a staggering 10,000,000 THETA for a Validator Node.

It gets more interesting with the newly introduced Guardian Nodes. Still, you need 100,000 THETA to operate such a node. Some of these can then become validators if they are selected by the rotation principle. However, this does not change anything for the staking reward, which is fixed by the protocol

Earn TFUEL

If it is less interesting to run a node, even the “normal” use of the network can be profitable. As mentioned above, viewers get TFUEL for watching video content. However, this is admittedly quite a small amount.

The platform Cake DeFi provides an easy and user-friendly way to generate passive cash flow on your crypto portfolio. This is done in three different ways, called lending, staking, and liquidity mining. All you have to do is to sign up for the platform, top-up money via credit card or transfer cryptocurrencies and put your assets to work. Read more.

You receive a 30$ signup bonus upon your first top-up with the following referral code:

Another way to earn passive income with crypto is Curve in combination with Crypto.com Cashback. Take a look at This Is How You Can Add Every Card To Google/Apple Pay

This could be one of the most interesting platforms I have reviewed lately. Why? Strong team and advisors with a track record, real-life use cases, and interesting partners.

Advantages

- Growth market “video streaming”

- High incentives for platform users

- Technically advanced design

- Enormous price increases in the past

Disadvantages

- High volatility

- Tough competition from central CDNs such as Amazon AWS or Google Cloud

How To Buy $THETA?

For newcomers, I’d personally recommend crypto.com* as an easy-to-use trading platform with a user-friendly interface and step-by-step instructions. Crypto.com*offers a whole ecosystem with a credit card (including crypto-cashback), staking, and many more features. Read more here.

For anyone seeking a more advanced platform with lower fees, give BitForex* a try!