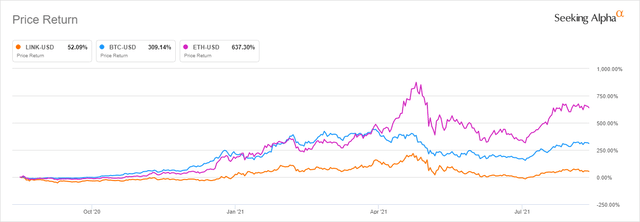

Bitcoin (BTC-USD), Ethereum (ETH-USD), and Chainlink (LINK-USD) are the most blue-chip cryptocurrency assets. Bitcoin is a storage of value, Ethereum enables decentralized applications, and Chainlink provides trustless data feeds for such applications. Each are fundamental to the long-term growth of the global cyber-economy. Of these three assets, Chainlink is currently the most undervalued.

Source: Seeking Alpha

What is Chainlink?

To understand Chainlink, you first have to understand what Ethereum is and how it works. Essentially, Ethereum is a decentralized version of the internet. It is revolutionary because it allows for virtual applications to execute without any reliance on a centralized third party. Rather than depend on cloud companies to host websites and run applications, Ethereum completes these processes within a decentralized blockchain. “The big idea behind Ethereum is that anybody can use this new, decentralized network to create and run decentralized applications”, quoted from Upfolio.

So, Ethereum is a platform where blockchain developers can build and host decentralized applications. However, the initial release of Ethereum back in 2013 came with three major problems:

- Ethereum cannot scale. If too many transactions flood the Ethereum network, Ethereum’s node operators become overwhelmed and the entire network stalls.

- Many applications built on Ethereum require access to real-world data. For example, if you want to host a weather app on Ethereum, then your app will need reliable access to weather data.

- Ethereum cannot execute computationally heavy transactions. Due to an inherent process within maintaining blockchain consensus known as the ‘Verifiers Dilemma‘, the Ethereum network can only execute simple tasks.

Chainlink was developed as a response to these problems. Initially, Chainlink was created with the single function to provide outside data to decentralized applications. As of late, however, Chainlink has grown to address many fundamental problems within blockchain. Where the crypto-economy currently stands, the vast majority of decentralized applications rely on Chainlink to function properly. Going forward, this reliance on Chainlink is likely to increase within the cryptocurrency space and within relating enterprise applications.

Chainlink’s Growth

Presently, Chainlink has already achieved its 2017 goal of becoming an essential source of trustless data for decentralized applications. In April, however, Chainlink expressed some much more expansive ambitions with the release of its Chainlink 2.0 whitepaper. Going forward, Chainlink will provide a broad suite of decentralized services to be used by both blockchains and private enterprises.

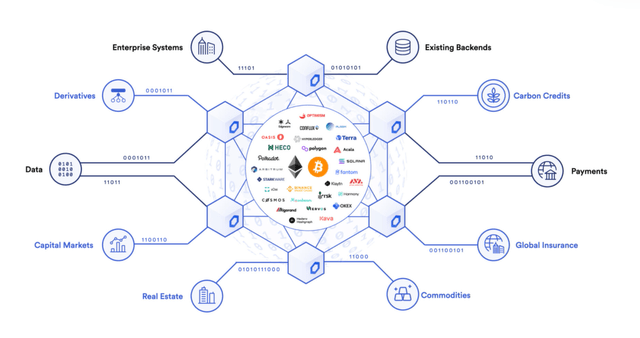

If the ambitions expressed within Chainlink’s 2.0 whitepaper come to fruition, the ramifications will be immense. In the paper, the Chainlink team expressed its vision of a global economy backed by ‘cryptographic truth’. Where it currently sits, Chainlink is positioned to become the primary bridge between the legacy internet, the decentralized internet, and the real-world.

Source: blog.chain.link

At Chainlink’s recent Smart Contract Summit, Co-founder Sergey Nazarov stated that Chainlink is prepared for a world where all financial contracts are composed as smart contracts, or code that is stored and executed on a blockchain. As decentralized applications become increasingly complex, society will shift away from a ‘trust-us’ centralized model in favor of auditable, secure, and trustless executable code.

Hybrid Smart Contracts

In the 2.0 whitepaper, Chainlink’s development team identified a new term known as ‘hybrid smart contracts’. While smart contracts’ refer to code processed entirely on a blockchain, ‘hybrid smart contracts’ allow for more scalability and opportunity by linking the code to a decentralized oracle network. Through hybrid smart contracts, Chainlink plans to shift data storage and computation off layer-1 blockchains and onto itself, thereby creating a host of new opportunities for decentralized applications.

By allowing for off-chain storage and computation, Chainlink’s hybrid smart contracts solve the third fundamental problem with Ethereum I previously listed (the inability to process computationally heavy transactions). Going forward, if an Ethereum application wants to run a voluminous task, it can outsource the work to Chainlink. This is huge, in that now blockchain applications may perform all the same functions that legacy internet applications accomplish.

Source: blog.chain.link

Cross-Chain Interoperability Protocol

Chainlink’s oracle service is currently integrated with between 50% and 80% of all DeFi applications. Since Chainlink’s presence is already so expansive, the project is positioned perfectly to act as a connective bridge between all of crypto’s separate blockchains. Chainlink’s Cross-Chain Interoperability Protocol seeks to create a new open-source standard for cross-chain communication. Essentially, Chainlink plans to become the fundamental operating system for cross-chain token movements and messaging. Once again, this creates new opportunities for decentralized applications. Celsius (CEL-USD), for example, plans to use Chainlink’s interoperability protocol to tap into DeFi yields.

Price Analysis

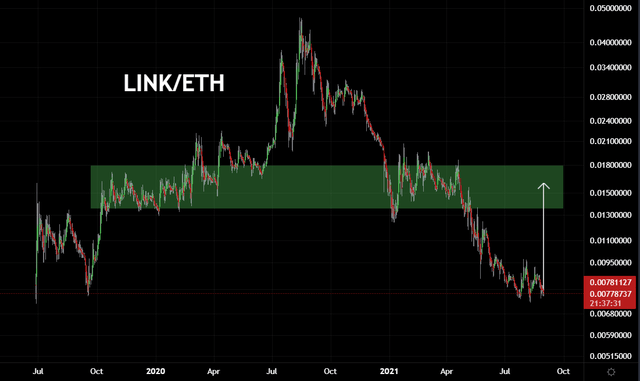

In my assessment, Chainlink is currently sitting in a buy position. Ethereum seems to be absorbing most of the hype in the crypto market due to its ongoing NFT craze. As of August 30, Chainlink is placed at an all-time low versus Ethereum (0.007 Eth / 1 Link). Since its mainnet launch in 2019, Link has had major support around 100% above this price on the Ethereum chart (0.01 – 0.02 Eth / 1 Link).

Source: Author

If Chainlink can once again reach 0.02 Eth per Link, at Ethereum’s current price, this would place the Link token at about $65, or a 2.6x increase from its current price of $25.

Taking a more long term approach, it’s my opinion that Chainlink belongs to be a top 3 market cap coin. Some of the current top 10 coins don’t deserve their market capitalizations (for example, Cardano (ADA-USD) with $87 Billion, XRP (XRP-USD) $51 Billion, and Dogecoin (DOGE-USD) $35 Billion). Presently, near nobody uses these coins for their utility. Instead, all the investors are speculators. This surplus of short-term traders is a direct result of the crypto-economy still being in its infancy. In the end, utility should win over speculation.

At today’s prices, if Chainlink were to become a top 3 coin, its token price would equal about $200 per Link.

Risks

Overall, there are two risks associated with securing the Link token as an investment.

- 55% of Link’s total circulating supply is currently held in the development team’s treasury wallets.

- If Chainlink’s ecosystem grows big enough, it could be sanctioned to a ‘toll-bridge’ status. Over time, users may become disgruntled with Chainlink’s monopoly on data transfer, and instead opt to use non-token oracle services.

In general, an investment in Chainlink is synonymous to an investment in smart contracts and blockchain services. The biggest risk I see with Chainlink is that it could become a victim of its own success. Presently, however, I am not worried about competition stealing Chainlink’s market dominance.

Key Takeaway

The key takeaway is that Chainlink’s improved suite of decentralized services are ‘accelerating the adoption of cryptographic truth’. Chainlink is specifically poised to expand total cryptocurrency adoption by increasing the overall utility of decentralized applications. Through Chainlink, private enterprises may collectively gain access to the benefits of DeFi, and other applications such as ownership rights, insurance processes, payment rails, and capital markets will have the opportunity to become decentralized.

The three most blue-chip assets in crypto (Bitcoin, Ethereum, and Chainlink) are all simultaneously experiencing major improvements within the next year.

- Near the beginning of November, Bitcoin will undergo its ‘Taproot’ upgrade.

- Phase 1 of the Ethereum 2.0 upgrade will likely occur near the end of 2021. This will split the Ethereum blockchain into 64 corresponding chains, and conservatively enable 64x more transaction throughput.

- With the release of its 2.0 whitepaper, Chainlink is expanding to become the ‘cloud computer’ of crypto.

All this, combined with Bitcoin’s distance from its past halving event, seems to be creating a perfect bullish storm for cryptocurrencies near the end of 2021. Of crypto’s most blue-chip assets, Chainlink currently seems to be the most undervalued and under-hyped.