salarko/iStock Editorial via Getty Images

With over 21,000 cryptocurrencies now on the market according to CoinMarketCap, some of the coins that have been around for 4 or 5 years can be forgotten while newer tokens capture the interest of speculators. One coin that probably fits that mold is Zilliqa (ZIL-USD). Despite claiming a fast and scalable blockchain, ZIL has quietly maintained a presence in the top 100 but is rarely mentioned among potential long term layer 1 winners. Zilliqa has been in the news lately after announcing a Web3 gaming console launch to come in 2023. In this article, we’ll take a brief look at the token and the network before we dive into the gaming console.

Network and Token

Zilliqa was first conceived in 2016 by Prateek Saxena and several other students at the National University of Singapore School of Computing. It is claimed to be the first blockchain that used sharding. Sharding is the process of segmenting transactions to different blockchain node groups so that all of the nodes on the network don’t have to store every single transaction. This theoretically increases the scalability of a blockchain because transactions are done with more of a batch-like process. This enables more transactions per second because they’re done simultaneously. Transaction speeds can then be much faster than blockchains that don’t currently shard like Ethereum (ETH-USD).

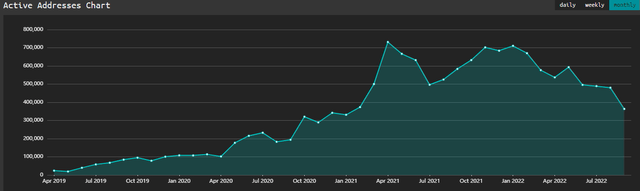

As far as network usage goes, growth has been a bit mixed. The monthly active addresses on the network, while strong from 2020 to 2021, has stalled considerably. In April of 2021 there were over 731k active monthly addresses. Currently there have only been about half of that in September.

ZIL Active Addresses (Monthly) (ViewBlock.io)

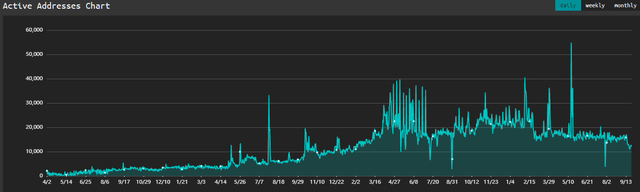

From a daily active wallets perspective, there have generally been between 15k to 16k each day over the last several months.

ZIL Active Addresses (Daily) (ViewBlock.io)

That figure is now down to about 12k in September. As far as a DeFi presence goes, about 5.5 billion of the 13.3 billion circulating supply of ZIL is staked and generating an average yield of 12.6% according to ViewBlock.

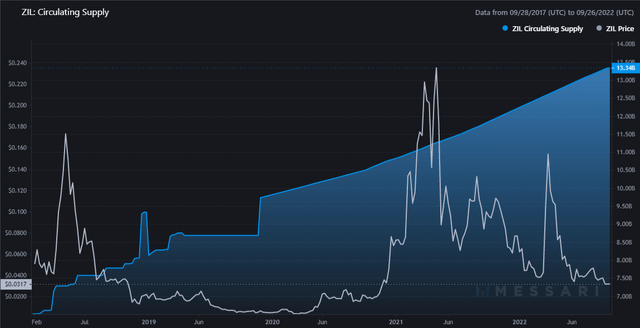

Messari

At $0.0316 per ZIL, this would give Zilliqa a $421.5 million market cap and imply roughly $165 million in TVL. At a little over 2.5, Zilliqa has a smaller MC/TVL than larger peers like Ethereum, Solana (SOL-USD), and Avalanche (AVAX-USD). The general thinking in DeFi is the smaller the MC/TVL, the more undervalued a network potentially is. Despite all that, it’s gaming rather than DeFi that has had Zilliqa enter my purview.

Play-To-Earn Opportunity?

One of the more interesting opportunities in crypto is in the play-to-earn space. This year, we’ve seen the rise and decline of the popular lifestyle move-to-earn app STEPN (GMT-USD) (GST-USD). And there are other play-to-earn games in the crypto space that have also become well known, for instance Axie Infinity (AXS-USD), Splinterlands, and Upland. One of the problems that public blockchains potentially solve for gamers is the return on time aspect of gaming. When a player commits months or even years to a game before losing interest, there is usually no cash-out on all of the time that has been put into playing the game.

Video games often have in-game currencies, points, or assets that are very valuable in the games themselves. Despite that, players generally don’t have a way to easily convert those rewards or assets to currencies that can be used outside of the gaming ecosystem. While the expectation that a player should get a return on time might seem ridiculous to some, it’s not actually as crazy as it might seem. Gaming in the real world almost always allows for some sort of conversion out of in-game tokens.

For instance, players of popular card games like Magic The Gathering or Pokémon have always been able to sell their valuable cards if they no longer want to play. Furthermore, anyone who sets foot in a physical casino uses the house-native chips rather than real currency. If they’re lucky enough to still have any left, players can cash out their gaming chips for fiat currency when they’re finished playing.

Gaming Hub and Zilliqa Console

While there is still quite a bit to figure out in the play-to-earn space from a sustainability perspective, Zilliqa is taking an interesting approach to the P2E model by developing a blockchain-based gaming ecosystem and hardware console. According to the Decrypt article with the announcement:

Players will be able to earn Zilliqa (ZIL) tokens through the completion of in-game “skill-to-earn” missions, tasks and quests. In this case, the tokens can be regarded as similar to coins or rewards in traditional games, but with the added functions of blockchain technology.

This could mean that no matter which game the users are playing, as long as the game developer supports the ZIL mining through the console, players have an incentive to play games within the Zilliqa gaming ecosystem. And we are already starting to see some of the vision that the Zilliqa team has through the development of the “Web3War” first person shooter game.

Web3War Skins (W3W.game)

Players of the game can reportedly keep their skins, weapons, and equipment as blockchain assets. They can then trade them for other currencies like ZIL. There have been several videos online showing the gameplay, graphics, and maps and there is definitely a Nintendo 64 feel to it. The challenge that I think Zilliqa is going to face with this gaming approach is keeping players interested in a game that is several years behind competition aesthetically.

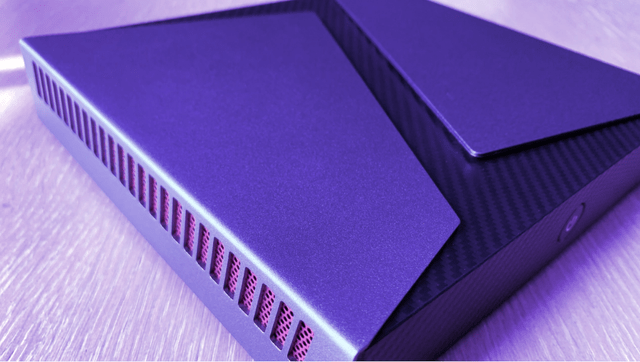

Zilliqa via Decrypt

The console itself, while pretty slick visually, appears to be an EGlobal device that uses older Nvidia (NVDA) chips. I actually think this is the correct approach to creating a blockchain-based gaming ecosystem because it means Zilliqa can essentially white label a console and not have to worry about building an entirely new device from scratch. Rather, Zilliqa can focus more on building the blockchain gaming integration with an existing device to prove the concept. What’s also interesting about the planned console is the device will be able to passively mine ZIL when the user isn’t playing any games.

Risks

What is still unknown is how much the console costs. I don’t see any way this console will be able to attract non-crypto native gamers if it’s more than a couple of hundred bucks. Since the graphics of the games are going to be such a large downgrade from the leading systems like X-box and Playstation, there is going to have to be a much lower cost to purchase in my view. If not, the console is likely going to only appeal to people who are already in crypto and who are already playing video games.

While that’s still likely several million people, I believe it takes that addressable market way down from what it could be if the console is priced properly. The other issue though is even if it is priced attractively, some in the gaming community are adamantly opposed to crypto and they may reject the Zilliqa console out of personal principle.

Summary

Zilliqa now has my interest when it didn’t before. If the development team working on Web3War can create a video game that is actually fun enough to play despite the clear aesthetic drawbacks, I think ZIL gets a passive bid through gamers earning the token. As far as the network goes more broadly, I’m not as enthusiastic about Zilliqa. I think there are better layer 1 chains that have more going on.

I believe white labeling pre-existing tech is probably the right approach for what Zilliqa is trying to accomplish with blockchain-based gaming integration. If there is robust demand for the gaming ecosystem built on the network, the company can rethink an original console build if the economics make sense. I’m not long ZIL today. I want to see what happens with the console pricing and sales first.