Chainlink has attracted investor eyes and high social volumes over the last few days owing to the developments in its ecosystem. The support from whales and positive social sentiment for the project has garnered price gains for LINK.

From Sept. 22, LINK gained over 20% picking up from the lower $6.80 price level and making its way to the press time price level of $8.01. Analysts have noted a decoupling narrative in LINK’s price action as the altcoin experiences a period of increased whale activity.

Decoupling from top crypto assets

Since Sept. 21 Chainlink has been showing hints of being somewhat decoupled from the larger crypto market, according to data from Santiment. After reclaiming the $8 threshold again, LINK has reversed its mid-September losses

A fall in LINK’s correlation with Bitcoin from Sept. 10 onwards aligns with the price gains noted by the altcoin over the time period.

Apart from the dropping correlation, another sign of decoupling was the LINK/BTC pair breaking above a long-term resistance level. Pseudonymous analyst and crypto investor CryptoGodJohn pointed out that the pair was on the brink of breaking out of a 780+ day downtrend.

The veteran trader also highlighted that LINK is one of the first coins to pump out of the bear market into the bull market and one of the first coins to enter a bear market during the bull market.

LINK whales back in the game

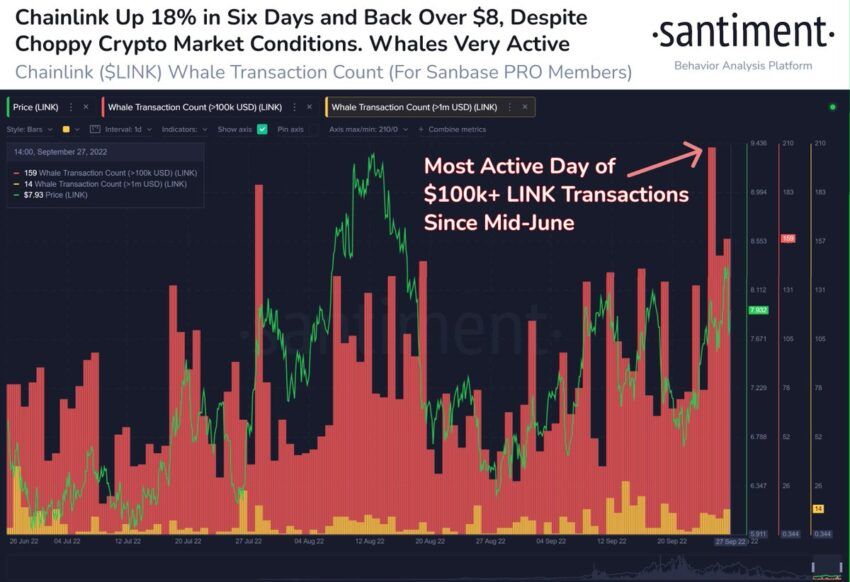

The recent solo run shown by LINK’s price managed to bring back whales to the scene with whale transactions noting a significant uptick. Recently, LINK saw its most active day of $100k+ transactions since mid-June.

A higher activity from whales amid positive price momentum and decent retail volumes can further aid LINK’s bullish trajectory in the near term.

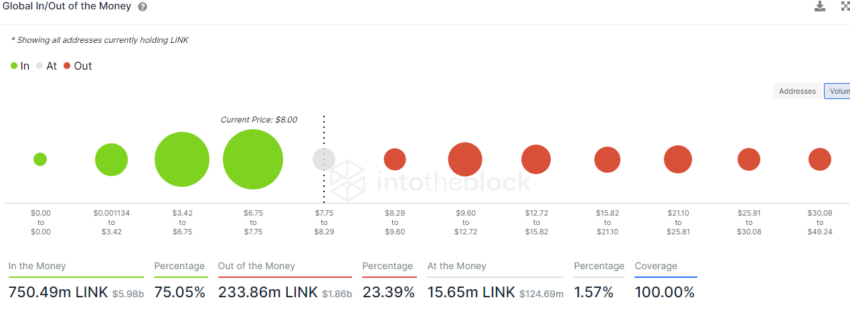

For now, bulls would need to keep LINK’s price above the $7.95 mark where over 15 million LINK are held by 9,370 addresses. The next solid supply barrier as per Global In and Out of Money is at the $8.92 mark where over 13 million LINK is held by over 15,000 addresses.

At press time, LINK oscillated at $8.05 but was down by 3.4% on the daily chart owing to the larger market’s bearishness. However, a pullback below the $7.95 mark could lead to a u-turn to the $7.22 mark which is the next support barrier.

For now, the upcoming SmartCon Chainlink event scheduled for Sept. 28 has kept social euphoria high for the project and could potentially further boost LINK’s price in the near term.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.